Brian possess almost two decades of experience exercises when you look at the classrooms and being employed as an exclusive teacher to own levels seven because of several. He’s a great Bachelor’s Training at this moment with a focus toward 20th century U.S. Records.

- What is Redlining?

- Redlining Records plus the Higher Anxiety

- Redlining Meaning Today

- Segregation vs. Individual Monetary Issues

What exactly is redlining in simple terms?

The thing that makes redlining unethical?

Redlining mode doubt monetary services to one situated solely towards its competition otherwise ethnicity. It is shady to use battle or ethnicity since a basis for qualifying to own credit or other financial properties.

What’s redlining in history?

Typically, redlining makes reference to a practice of the FHA and you may HOLC to help you refuse home loans to the people located in low-light communities. These types of providers drew red outlines doing low-white areas into charts so you can specify them as unworthy from financial support.

Table away from Contents

- What’s Redlining?

- Redlining web site here Record therefore the Higher Despair

- Redlining Meaning Now

- Segregation vs. Individual Financial Situations

What is actually Redlining?

In recent years, the phrase redlining have starred in the newest media into the reference to societal products from inside the Western record, eg circumstances over endemic racism. What is actually redlining? Predicated on Cornell Rules College or university, “Redlining can be described as a discriminatory habit you to consists of the fresh new medical assertion from attributes like mortgages, insurance coverage loans, and other monetary properties so you’re able to customers of certain areas, according to their battle or ethnicity.” As the routine first started on 1930s, the phrase redlining are coined in the 1960s of the sociologist John McKnight.

Redlining Background plus the Higher Despair

The real history of redlining first started inside the Great Despair. Financial adversity hit the us on later 1920s and early 1930s. By the 1933, brand new unemployment rate is actually higher than 25%, revenue got plummeted by the over fifty percent, and over a million Us americans was in fact against foreclosures on the home. In reaction, President Franklin Delano Roosevelt released a giant personal and you may financial recuperation program the guy called the The new Price. Main on the promise of the The Bargain is FDR’s belief that owning a home try the easiest way having Us americans to safe and you will accrue wealth. As a result, the government created organizations that would give federally covered mortgage brokers to help you potential customers. Although not, some demographics, mostly black People in the us, were methodically declined those individuals pros. In essence, it practice of doubt lenders to help you People in the us inside low-white neighborhoods created a system regarding institutionalized segregation all over the country.

Segregation’s Meaning plus the The fresh Deal

Segregation setting separating individuals based on competition or ethnicity. This is a common habit in most elements of the fresh U.S., especially in brand new South, adopting the prevent of your Municipal Battle through to the civil-rights actions of 1960s. Jim-crow rules from inside the south states blocked black colored People in the us out-of eating in identical dining, hunting in the same places, and you may planning to an identical colleges given that light People in america. From the Great Anxiety, communities in the most common biggest Western towns had been split together racial lines. While FDR’s The new Deal was created to handle the nice Anxiety, policies created to bring mortgage brokers fundamentally cemented these types of segregated teams and authored monetary disparities between grayscale Americans for a long time to come.

Segregation and you can Authorities Firms

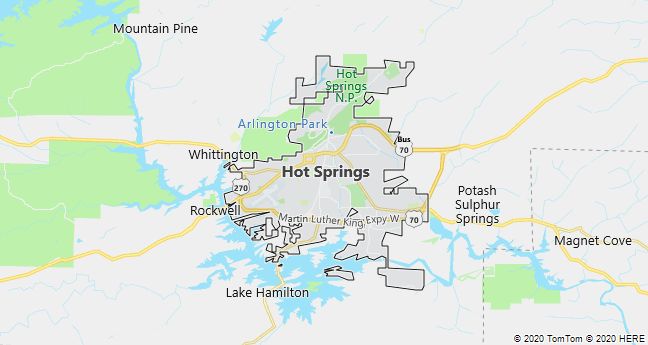

From inside the 1934, the latest Government Property Management (FHA) was created to insure mortgage loans so you can private individuals and you may designers appearing to construct brand new casing developments. Likewise, the homeowners Loan Agency (HOLC) was designed to supply the FHA covered financing. In order to regulate how best to dispersed the newest domestic loans, the federal government accredited charts of any big area in the united kingdom. The newest FHA and HOLC up coming color-coded the brand new charts to employ and this neighborhoods was indeed “safe” for financing. Along with codes integrated eco-friendly having “most useful,” blue to own “common,” yellow getting “decreasing,” and you may purple getting “risky.” The newest designations broke off with each other nearly entirely racial outlines. Mainly black colored areas, if not portion located close black colored neighborhoods, had been colored red-colored, showing this type of portion while the hazardous to possess financial support.

Segregationist rules went past just colour-programming charts. Trusting black household getting into light areas perform all the way down property viewpoints, black colored Us citizens was indeed definitely stopped out of to acquire for the white neighborhoods. With regards to the FHA’s Underwriting Guide, “incompatible racial teams shouldn’t be allowed to inhabit the fresh exact same teams.” This new manual plus advised that the building off roads is always independent monochrome neighborhoods.

Sometimes, covenants were used to prevent black family members from purchasing property in white communities. This type of covenants eliminated white home buyers out-of subsequently offering their houses to black colored customers. Probably the most well-known exemplory instance of this really is Levittown, one of the primary suburban improvements, based in Nassau Condition, A lot of time Area. Purchasers in Levittown have been necessary to indication a rent saying they you can expect to rent otherwise sell the property to help you “any individual other than people in the brand new Caucasian race.” Implementation of such formula welcome this new FHA and you will HOLC to help make racially segregated groups in the united states.

Connect with us