To find a special residence is a captivating trip, however it is as well as a financial union that requires cautious considered and you may attention. One of the most essential regions of securing a great home loan rate and mortgage terms and conditions is protecting your credit score. Actually a slight drop on the credit history have an effective tall impact on what you can do so you’re able to qualify for a home loan and you will the overall cost of your home mortgage. Here are a few extremely important tips about how to safeguard your own borrowing rating into the mortgage process.

step one. Quick Payments Try Low-Flexible

The foundation from a healthy and balanced credit rating is actually while making repayments for the day. So it holds true for your entire present borrowing obligations, off playing cards and you will automotive loans so you can student loans and personal money. Late repayments can result in your credit rating in order to plummet and you can raise red flags which have loan providers. Always maintain your existing expenses and prevent late repayments without exceptions.

Install reminders, speed up payments, otherwise play with budgeting software to stick to best off debt financial obligation. Think of, your percentage record accounts for a life threatening percentage of your borrowing score, so keeping a perfect background is essential.

2. Spend More the minimum

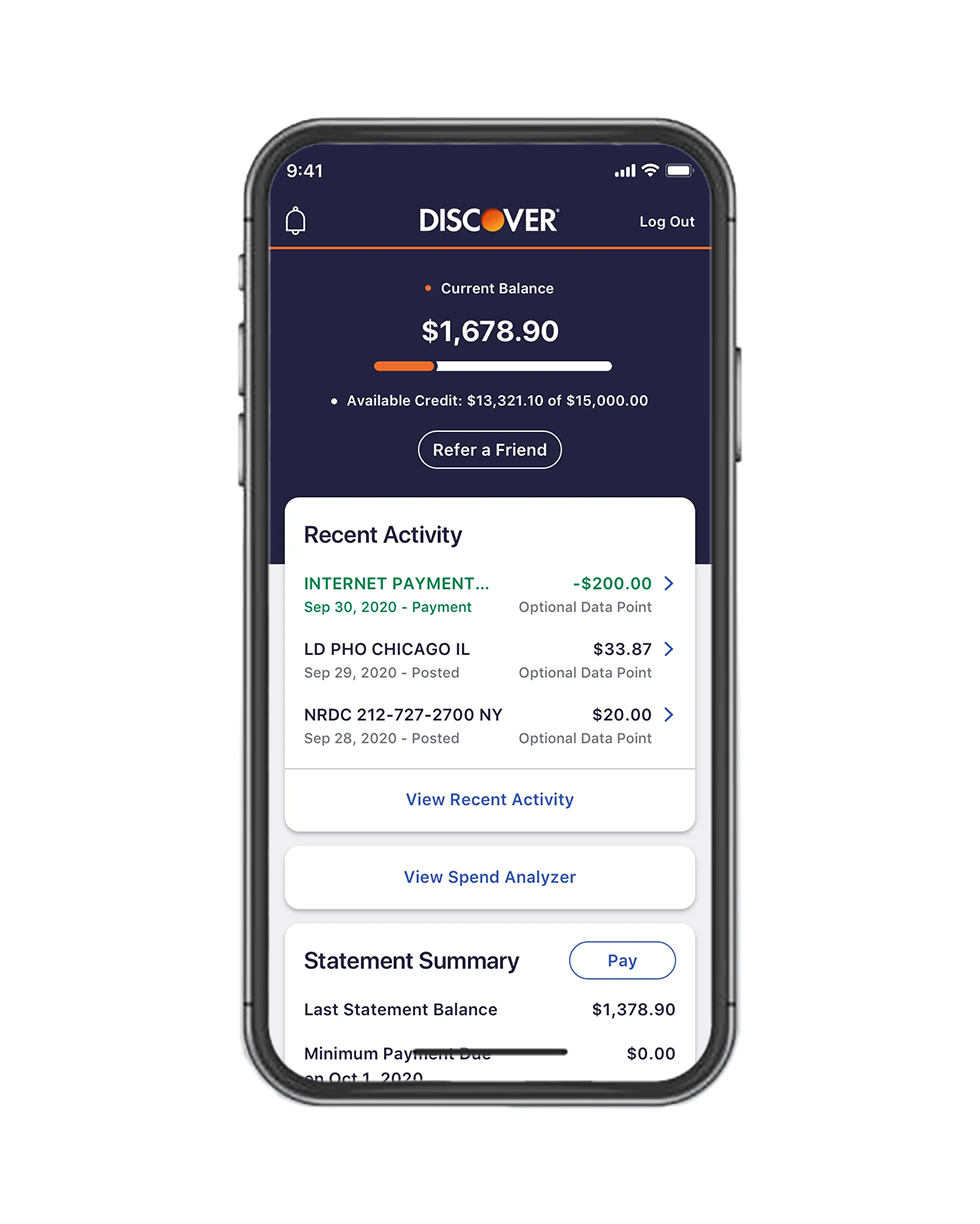

And make quick costs is extremely important, it’s also advisable to shell out more than the minimum requisite number as much as possible. Credit scoring habits be the cause of your credit use ratio, the number of borrowing you may be using than the your own total available credit. If you are paying off your own stability and you will lowering your borrowing from the bank use, you could potentially undoubtedly impression your credit rating.

Try and repay the balance on the handmade cards monthly, rather than just making the minimum payment. So it reveals in control financial decisions and can boost your creditworthiness inside the fresh new attention out of lenders.

step three. Employment Stability Issues

Lenders consider carefully your a position records and you can balance whenever comparing the creditworthiness. A sudden employment change otherwise loss of a career can boost issues to possess lenders, probably delaying or derailing the loan application.

If you’re considering a job transform inside the home loan procedure, it is essential to discuss this with your financing manager. They are able to promote recommendations on exactly how this might connect with the loan application and you will counsel you on most readily useful course of action.

4. Prevent The new Borrowing from the bank Applications

Starting the brand new lines of credit otherwise making an application for the latest money while in the the house mortgage procedure normally somewhat effect your credit rating. Every time you make an application for credit, a challenging query was recorded on your own credit report, that will reduce your get temporarily.

To safeguard your credit rating, refrain from obtaining the fresh new handmade cards, personal loans, and other types of credit until once your home loan features closed. Work at looking after your present credit dating during this vital go out.

5. Decrease Highest Purchases

Its enticing first off furnishing your brand-new house or and make big orders into the expectation away from homeownership. Although not, and also make extreme costs, particularly to purchase furniture or devices, can increase their borrowing use and you will potentially harm your credit score.

You might want to attend up to immediately after the loan closes and come up with these large commands. This implies that your credit rating stays secure about domestic loan process and will not jeopardize their mortgage acceptance.

six. Be mindful that have Dollars Dumps

Highest, unexplained bucks dumps in the savings account can raise concerns for lenders, as they will get matter the cause of these loans. In some cases, this type of deposits eters.

If you wish to deposit a significant amount of bucks towards your account, be prepared to render an obvious paper walk you to definitely data the newest source of these financing. Visibility is vital with respect to monetary things inside mortgage processes.

https://cashadvancecompass.com/installment-loans-mi/portland

eight. Maintain Open Communication together with your Financing Administrator

In the mortgage process, its imperative to maintain open and you can sincere communications together with your mortgage manager. Let them know of every change with the money, expense, commands, or any other financial things timely. The loan administrator also provide information how these types of change can get affect the loan app and you will just what steps you need to sample decrease any negative has an effect on.

To conclude, securing your credit rating inside mortgage processes is the vital thing to help you securing a great financial rate and you can mortgage conditions. By simply following these suggestions and you may existence patient within the handling your bank account, you could potentially make certain a softer and you can be concerned-totally free homebuying experience. Think of, your credit rating is an asset, and you may retaining it needs to be a top priority as you embark on your own homeownership travel.

Owing to the flexible financial choices, Alternatives can help you grab new pleasure regarding another type of home. We of experienced domestic lenders focuses primarily on sets from pre-qualification for the final payment. We are right here to you personally every step of your method.

Connect with us