Which have a credit history out-of 550 gift suggestions particular demands when looking to a loan. A number of the preferred barriers you could run into is:

- Minimal Mortgage Possibilities: Having a reduced credit rating, your loan selection is generally limited. Antique lenders, such as for instance financial institutions and you can borrowing unions, normally have stricter borrowing from the bank requirements and may even getting less likely to want to accept funds for those with down credit ratings.

- Higher Rates: Loan providers imagine lower credit ratings just like the an elevated credit exposure. This means that, if you are acknowledged for a loan, you happen to be considering higher interest levels. This may result in large monthly installments and you may overall financing will set you back.

- More challenging Recognition Procedure: Getting that loan having a great 550 credit rating can get cover a beneficial significantly more rigorous acceptance procedure. Loan providers can get demand additional paperwork, wanted a great cosigner, or inquire about security so you can offset the risk with the mortgage.

- Shorter Loan Numbers: Lenders ounts to people that have down fico scores. This will help decrease the chance on the lender if you are still delivering particular financial assistance.

It’s important to just remember that , if you find yourself a great 550 credit history get expose pressures, it doesn’t mean you simply will not manage to safer financing. There are choice mortgage possibilities, such as for instance secured personal loans, payday loans, or handling on the web lenders, and this we’ll speak about next point. Simultaneously, providing strategies to evolve your credit score can increase the possibility out-of financing recognition and possibly promote usage of way more good mortgage words.

Securing financing having a credit history away from 550 is going to be challenging, but it is perhaps not hopeless. There are many financing available options for people that have lower credit ratings. Inside section, we shall discuss three prospective alternatives: secured loans, payday loans, and online lenders.

Secured loans

Secured finance would be a practical option for individuals with good 550 credit history. This type of fund try backed by security, such an automible, home, or any other valuable assets. Giving security, individuals reduce the exposure to own lenders, it is therefore expected to become approved despite a reduced credit get.

It is critical to meticulously look at the terms and conditions regarding shielded loans, since inability to repay can result in the loss of this new security. Simultaneously, rates to your secured finance tends to be highest as a result of the improved chance in the all the way down fico scores.

Cash advance

Payday loan was brief-label funds generally utilized for crisis expenditures. These types of loans usually are simpler to receive, even after a credit score away from 550. Cash advance are generally paid down in full throughout the borrower’s next salary, which makes them an instant provider getting quick economic demands.

When you find yourself payday loans may seem like an appealing choice for individuals having lower fico scores, it is vital to be mindful. Payday loans usually include high-interest rates and you may quick repayment terms. Borrowers is to meticulously examine their ability to settle the mortgage to the time to https://paydayloancolorado.net/gleneagle/ avoid shedding on a pattern out of personal debt.

Online Loan providers

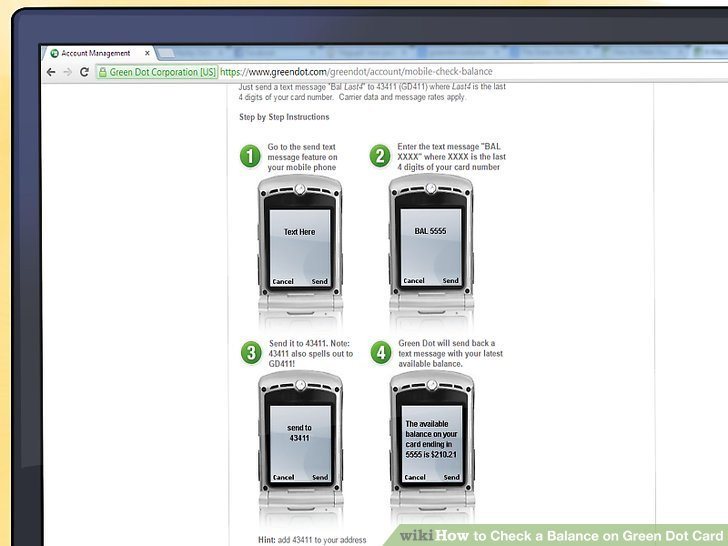

![]()

On the web loan providers are noticed instead of antique loan providers, offering finance to prospects with down credit ratings. These firms think some circumstances beyond just credit ratings whenever evaluating loan requests. They could envision money, employment background, or other financial signs to decide loan qualifications.

On the web lenders render convenience and you may accessibility, enabling borrowers to apply for financing from the homes. However, it is essential to meticulously opinion the conditions and terms, along with rates of interest and fees terminology, ahead of investing any financing agreement.

Whenever you are these loan alternatives tends to be designed for individuals with a 550 credit score, you will need to look at the threats and implications. Large rates, smaller installment terms and conditions, therefore the likelihood of accumulating even more personal debt can be very carefully examined. Examining choice an easy way to boost credit ratings or seeking to professional advice could be beneficial in the future.

Connect with us