The financial institution will at your purchase background and certainly will imagine if or not you really can afford the borrowed funds repayments. Even inquiries towards the purchase-now, pay-later properties is scrutinised.

eight. Applying That have Multiple Loan providers

Unnecessary concerns on your credit file can make it difficult locate a home loan, especially if you got 2 or more concerns over the last six months.

8. No Genuine Discounts

Legitimate coupons demonstrate that your protected a specific amount over the years on the a deposit for your home. Lump-share places such as for instance heredity otherwise gifted deposits, and you can abnormal bonuses, are not sensed genuine deals, just like the bank usually do not determine their discounts habits from their website.

nine. Ineffective Money

Lenders would like to know you could spend the money for mortgage repayments without having any financial difficulties. They’ll manage good serviceability sample to ascertain your debt-to-income (DTI) proportion. It will help them always will pay from your current expenses near the top of home financing and now have currency left. In the event the there would be virtually no money left, in that case your ability to pay the mortgage try asked.

ten. Shortage of Data files

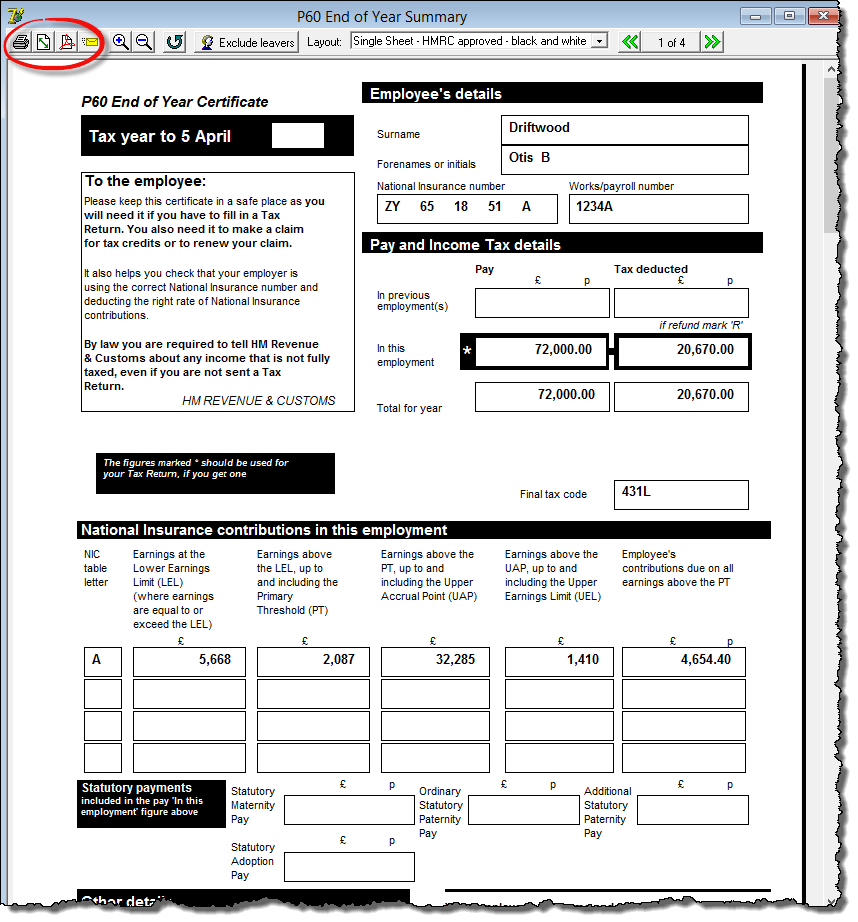

Lenders will demand data that show factual statements about your own a job, financial situation and make contact with information. Or no one among them data is lost otherwise provides the wrong guidance, the application is denied.

There is absolutely no special timeframe on what a lot of time you need to waiting so you can reapply getting a home loan. You should know why the application is actually refuted and take sufficient time to solve the difficulties.

To ensure the large risk of recognition, you need to await at the very least a year because lenders will appear during the software built in the final three to six days.

Normally A home loan Feel Refuted Just after Pre-acceptance?

- Missouri installment loans

- Your has just altered your work, as lenders commonly concern your task cover.

- You grabbed away a whole lot more credit immediately following pre-approval, and this develops your debt and you can DTI proportion.

- There were specific skipped and later payments on your own credit file just after pre-acceptance.

- You’ll find mistakes and you may inconsistencies together with your app.

- The financial institution found out recommendations throughout pre-approval that was perhaps not prior to now announced.

- The home we wish to purchase does not meet with the lending requirements.

- New lender’s conditions altered using your pre-recognition months, while never meet the new criteria.

When your app is actually declined even after it was pre-approved, pose a question to your lender why and attempt to fix the problems.

Can be Your loan Getting Rejected Immediately following Unconditional Recognition?

When you located a letter out of your financial providing unconditional approval, a clause says susceptible to next lender criteria. Thus, your home loan application are going to be refused, particularly when you’ll find drastic alter on the monetary circumstances during the application techniques.

One other way your residence mortgage can be refused shortly after unconditional acceptance is when the lenders Home loan Insurance carrier rejects the application.

What if I Already Ordered A home And Was Rejected?

For individuals who purchased a home using a private pact, there is an air conditioning-away from period ranging from step three and five days where you could opt out from the contract should your home loan wasn’t acknowledged.

There was a good susceptible to finance clause as part of the deal of marketing you to tells the seller you legally invest in buy the assets for the status you get specialized approval out of your lender. Which covers you against shedding your put or being sued from the owner. Discover limited differences in the latest clause off one state to another.

Unfortuitously, for folks who ordered a property on auction, there is absolutely no air conditioning-regarding months. In the event your financial application is maybe not approved, your chance breaking the deal and you can shedding your own deposit. That’s why a purchaser must do a professional pre-approval prior to bidding during the auctions.

Connect with us