Each day average financial rates has just dropped so you’re able to 6.34%, a minimal to have a 30-year fixed home loan while the . Costs features while the ticked right up somewhat, however they are however around the reduced height for the more than good 12 months. It significant decrease reveals a vital question getting residents: Ought i re-finance my financial?

Having costs now below they’re within the months, of a lot homeowners come in a primary position in order to review its monetary arrangements. Refinancing within a diminished price could result in good-sized coupons on monthly obligations and reduce the entire desire paid back across the lifetime of your own mortgage.

So you’re able to know if refinancing ‘s the best flow, this Redfin article will talk about the advantages, will cost you, and you may considerations on it.

Determining ranging from leasing otherwise buying your next domestic?

For many who ordered your house over a period of higher focus pricing, refinancing now is advantageous given that prices has dropped. The guideline is to refinance your own financial when focus prices are at the very least step 1% lower than your speed. Yet not, this can be only either the scenario. Considering your unique condition, it could be worth every penny to refinance whenever rates are merely 0.5% all the way down, or it would be best to hold back until interest levels was over step one% less than your existing rates.

Although this seems like a modifications, it can result in good-sized a lot of time-title coupons. A lesser interest rate can cause quicker monthly premiums, a quicker rewards of the financial, plus the chance to tap into domestic equity for further economic need.

Definitely continue an almost check out on the most recent financial cost in terms of refinancing to make certain you make more informed decision. If you’re considering refinancing your property loan, Redfin’s within the-house mortgage lender, Bay Security Mortgage brokers is a superb starting point. Get in touch with these to speak about your options to check out in the event the refinancing is the leader for the state.

The break-actually area

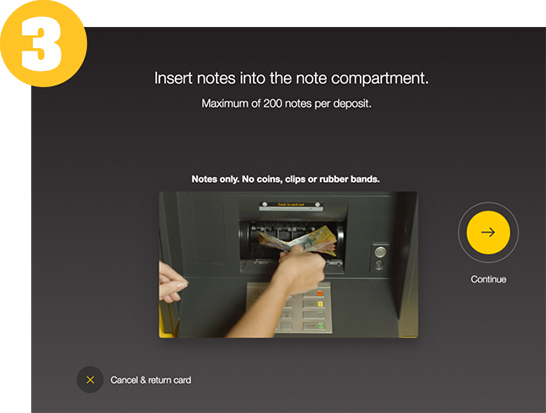

Your crack-even part is when you’ll recover all the closing costs that come with refinancing the loan. Instance, whenever the financial institution and you may term fees try $5,000 along with your monthly savings out-of refinancing try $2 hundred four weeks, it can take 25 weeks so you can breakeven.

As a whole, staying in your home is most readily useful unless you reach finally your break-also indicate ensure that refinancing will probably be worth they.

Exactly how much expanded you want to reside in your residence

While refinancing your own financial, one of the first facts to consider is where longer we would like to stay in your property. Consider if for example the latest domestic usually fit your life within the the near future. If you are alongside starting a family group otherwise which have a blank nest, while re-finance now, there clearly was a spin you will simply stay in your property for a short time to-break actually for the can cost you.

Your credit rating

For people who has just got aside another loan otherwise generated a belated fee, your credit rating may have been down, and therefore it might not be the best for you personally to re-finance. Fundamentally, the better your credit rating, the reduced the desire. personal loans for bad credit Kansas Really lenders want you to definitely individuals provides the very least credit history regarding 620-670. One which just refinance, ensure that your credit history has increased or resided a similar, and you fulfill the lender’s minimal requirements.

Can i refinance my personal family? Summary

In the course of time, choosing whether to re-finance their financial hinges on various issues, together with your newest rate of interest, the expense off refinancing, as well as your enough time-title financial desires. Having current cost shedding and also the potential for subsequent refuses, today tends to be an enthusiastic opportune time to envision refinancing.

Connect with us