Let us be sure to extrapolate to the term plan. Going through a divorce or separation is like riding long-distance. You could have an idea into the station you will get. But then you are able to face traffic jams, roads that are signed, injuries that are unforeseen and you have to help you adjust. That is to-be requested. And also for the stay-at-household mommy, so it excursion is commonly alot more tricky while we deal with simple tips to progress and you can reinvent ourselves while the divorce case files is closed.

You might feel you had made a contract with your husband which he was going to really works and earn, and you also was basically gonna stay home and take proper care of the latest students, now the fresh new carpet might have been yanked out of under you, says Emma Johnson, originator from WealthySingleMommy. Its an incredibly mentally wrought big date.

Moving forward economically since a stay-at-home mother need a review of your inflows and you can outflows from inside the detail to determine what your new typical is about to browse such as, and ways to create adjustments locate truth be told there. This is how to start:

Think carefully about your construction

If you’re keeping your family home might have been vital that you you mentally during the breakup, its critical to have a look at actual will set you back away from that household given that you are fully accountable for it.

Manage the newest wide variety cautiously observe what kind of an impact downsizing in order to a less expensive family may have on the money. Meaning taking a look at the price of the mortgage alone, also taxation and you may insurance rates and all of this new monthly payments relevant to your cost of our home along with tools, HOA and servicing.

And you will know that allowing wade sooner rather than later is generally suitable move: If you fail to pay the house, everything else is a strain, says Carla Dearing, Chief executive officer away from on the internet economic believed service SUM180.

Run their borrowing from the bank

Has just separated women usually see one to its credit history is gloomier than just they expected , possibly on account of poor obligations administration because a couple of when they was partnered or while they did not have borrowing in their names throughout their relationship.

Long lasting reasoning, given that you’re on your own, boosting your credit history is essential. A poor credit get can possibly prevent you from being able to rent a flat otherwise connect with upcoming a position, while a great get will make sure as possible accessibility funds at best possible cost. Begin reconstructing your personal by simply making small requests on a credit card and you will expenses them off instantaneously, and form other recurring costs so you’re able to vehicles shell out, so you will be never later. Incase you notice you can check here not get a card on your own individual, make an application for a secured bank card pronto.

Step back into workforce

Even though you discovered youngster help or alimony, you’re sure however going to need-otherwise wanted-to start earning money of the. The greater number of rapidly you might change from stay-at-home-mommy to beginning to earn their currency, the greater quickly you can safer your own economic freedom and you may regain your financial believe. Begin by calling friends and you can former coworkers to help you circle and have now the phrase out about what version of functions you’d instance.

Although you’re not in a position otherwise able to plunge returning to corporate life complete-time, you’ll find benefits to small-name and you may region-time work and you can gigs.

There are several ventures now, even before you pick your next industry flow, to function region-time and create some money to simply get by and continue maintaining some thing moving forward, says Jamie Hopkins, manager of your Ny Existence Cardiovascular system to own Old-age Earnings within new Western College or university from Economic Functions. A lot of people just make it work well month to help you week through to the best community chance reveals support.

Cover on your own from the bad

Since the you happen to be totally responsible for your home’s earnings, you’ll want to make certain you’re open to the new unforeseen . You to begins with a crisis cushion: Make an effort to kepted 3 to 6 months’ property value costs, so that a hospital bill or a leaky rooftop wouldn’t throw all of your current finances away from tune. In the event that given that a-stay-at-household mom 3 to 6 months’ isn’t achievable at this time, initiate small, setting aside slightly per month will grow faster than just do you believe.

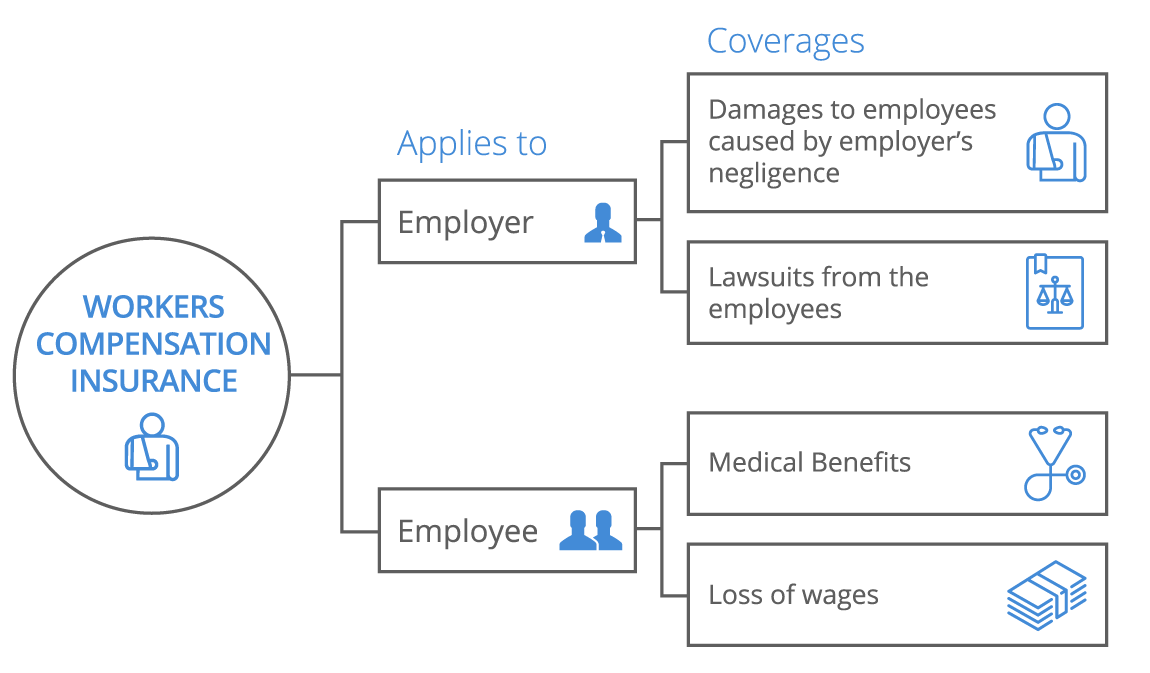

Also, think disability insurance coverage, that can protect your income if you’re harm otherwise become ill and cannot work with a time. And you may, whether your children are dependent on you to have investment, make sure you have enough life insurance policies to get all of them because of college and to your adult lifetime.

Improve your estate plan

You should capture another type of view all your avoid-of-life data files to see what, or no, changes have to be produced. You could potentially beat him or her-spouse while the beneficiary in your account and you will designate an alternate health care proxy and you will fuel away from attorney. In addition need certainly to perform an alternative usually, assuming you’d your ex partner-spouse listed in your old commonly states Stephanie Sandle, a certified Monetary Coordinator and you may handling manager away from MAI Financial support Government. By doing this when the something would be to takes place, you’ll be able to make certain the fresh new assets see who you require.

Contemplate, our company is along with you

Because the a-stay-at-domestic mom who has undergone a divorce, you’ve been as a consequence of a massive lives change. You will also have a summary of steps you can take, but anxiety perhaps not, you’re a great HerMoney purpose-getter! You’ve 100% got which, and you may we’re to you every step of your own ways. Signup united states on the HerMoney Facebook class . We are many solid. And the audience is these are what you.

Connect with us