- Freedom to your Property Form of: DSCR finance can be used to fund unmarried-nearest and dearest residential property, condos, condotels, non-warrantable apartments, and multi-family members (two to four-unit) functions.

The newest no-income verification feature means that buyers can be qualify for that loan according to research by the potential rental money of the home instead of its private money, which will be beneficial for individuals with low-conventional income offer. This particular aspect including simplifies the program process, minimizing the need for comprehensive documentation, such as employment history and you will bank statements.

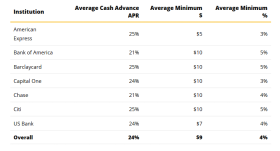

DSCR finance have several drawbacks. They frequently feature large interest ratesthan conventional mortgages due towards the improved chance of the no-earnings verification procedure. There could be also constraints with the sorts of attributes qualified getting DSCR fund.

One disadvantage to your DSCR financial design is that extremely actual home dealers lean into the and also make cash has the benefit of. However, leveraging an excellent DSCR financing enables these to build bigger instructions. And additionally, DSCR financing can be used to cash out on your present assets and rehearse the bucks proceeds to cover your future resource – without having any individual earnings confirmation.

Just how do DSCR Fund Compare with Almost every other Funding Choice?

DSCR money bring yet another chance of a house dealers, such those with low-traditional earnings supply. Its liberty makes them a stylish selection for of several dealers. However, it’s important to believe how they installment loans in Texas compare with other choices all over the newest board.

Antique Mortgage loans

Traditional mortgage loans, such as for example a conventional home loan otherwise FHA, is the most commonly known sorts of resource the real deal home requests. This type of fund require full income verification and you can an intensive credit check.

If you’re antique mortgages usually provide down interest levels and you will longer payment terms compared with DSCR finance, nevertheless they need large paperwork and certainly will bring longer to close off. That it disadvantage could well be a package breaker when time was off the newest substance so you can safe a good investment options.

Difficult Money Fund

Similar to DSCR finance, hard currency finance try small-label loans typically utilized by dealers who want quick financial support otherwise have been turned-down because of the antique lenders.

Difficult money funds differ from DSCR financing since they’re house-created. The house or property, maybe not the earnings, serves as equity in the event of default. These finance provide speed and you will freedom however, usually incorporate significantly high interest rates than simply conventional mortgages.

These finance should be suited to buyers browsing treatment and you may sell the house or property rapidly as opposed to maintaining the house or property just like the an effective revenue stream.

Private Currency Fund

Private money money are similar to hard currency fund, towards the no. 1 difference getting that loans come from individual some one or organizations in place of organization loan providers. Individual lenders focus on strengthening a romance using their clients and lovers, that financing promote considerable freedom on mortgage conditions and you will criteria.

They’re not managed exactly like bank loans. Like tough currency fund, they generally has large rates of interest and you can quicker fees conditions, but the benefit of personal money fund will be based upon the freedom and you may rates, causing them to best for traders who want brief capital.

Link Money

Connection funds, otherwise portfolio capital, is short-title financing built to “bridge” the brand new pit between the purchase of yet another possessions while the profit away from a current one.

link resource can often be utilized by dealers who need quick financial support to help you safer property because they wait for selling out-of a separate possessions or perhaps to render on their own longer to be eligible for permanent money. Same as hard currency and personal currency fund, rates and you will flexibility become at the cost of high interest levels and you may a dramatically shorter recovery big date, which have fee usually requested in this a year.

Connect with us