Do i need to very utilize the funds from a house Guarantee Mortgage TB to possess something?

The entire quantity of property Security Loan TB is actually a great mortgage when it comes down to mission, which means that there are not any conditions to file people objective and funds from the home Equity Financing TB tends to be used at the just discretion. The only exclusion are a posture if you are using the house collateral loan to repay almost every other money in cases like this https://paydayloanflorida.net/lake-placid/ you ought to pay people fund and people kept an element of the financing may be used when it comes to mission.

What is the difference between the user loan TB and Domestic guarantee financing TB ?

The consumer Loan TB a loan with an interest rate away from 5.9 % p. an effective. and maturity period maximum. 8 ages,

The house Equity Loan TB a loan with an interest rate away from 2.59 % p. good. with 12 months obsession and you may maturity two decades.

Is it possible to pay off your house Security Mortgage TB very early?

Sure, the house Collateral Mortgage TB can be paid very early, even in the place of a fee, into big date of one’s end of your own repaired-interest months. A consumer may also promote a remarkable deposit annually doing the latest 20 % of loan principal free of any costs. Plus these possibilities, the expense out-of very early installment ought not to go beyond 1 % of your own early paid down matter into the property financing.

Just what criteria carry out I have to meet easily should just take a property Guarantee Mortgage TB ?

- lowest decades 18 years,

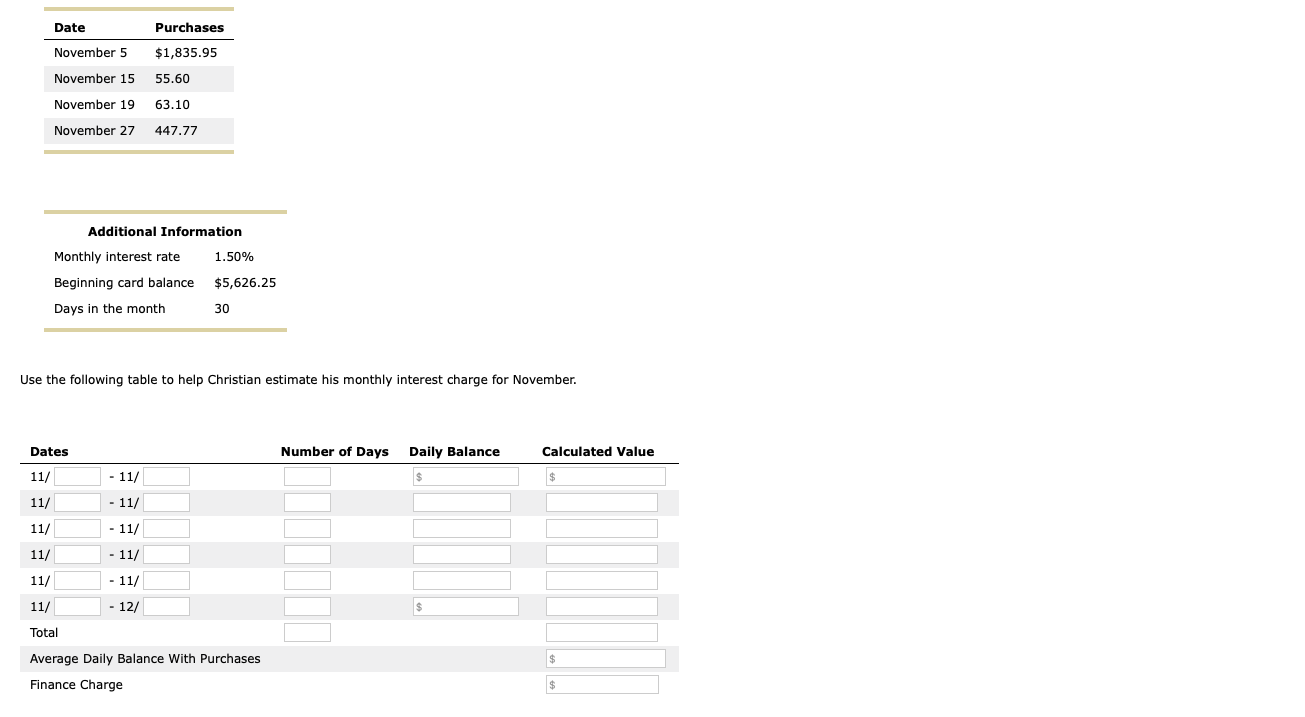

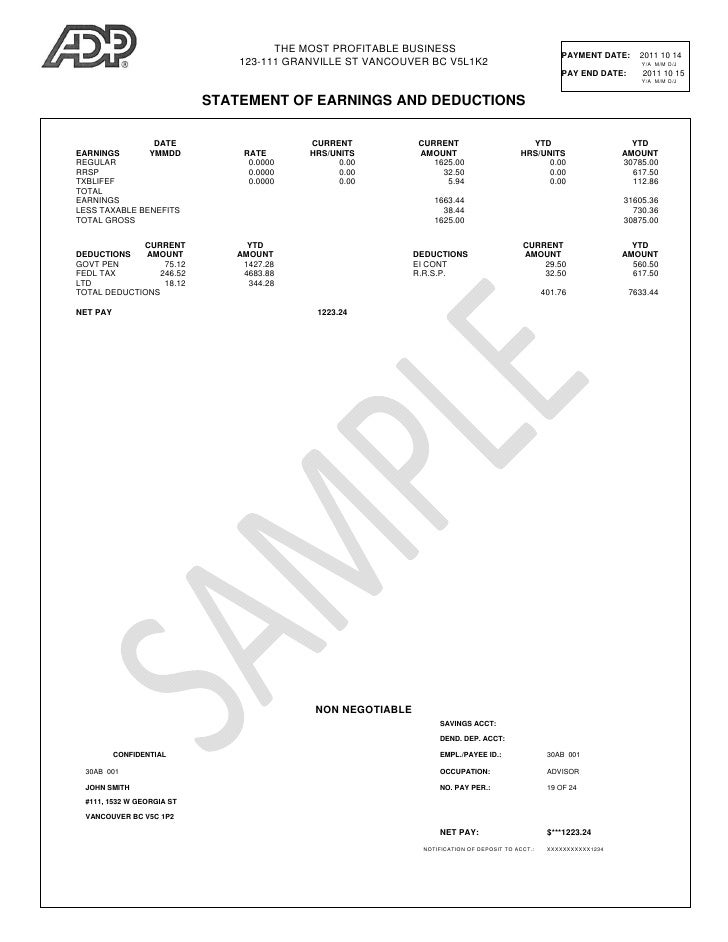

- paperwork out of latest net monthly money from five hundred EUR or even more,

- mortgage around the maximum amount of 80 % of one’s pledged property,

- restrict cost chronilogical age of two decades,

- a choice to play with an element of the financing to spend charges (financing payment and making sure professional review of apartment using Tatra banka),

- pledging of the construction possessions since the cover.

Can there be people insurance rates readily available if i in the morning not able to repay our home Security Loan TB ?

Yes, there’s. In the collaboration to the UNIQA insurance carrier you could plan new following thru cellphone solution Dialog Alive or perhaps in Tatra banka part:

- insurance policies of your capability to repay that loan, which will make you confidence in the event of unanticipated situations you to often prevent you from continuous to repay the mortgage,

- possessions insurance policies as possible strategy considering your position.

Exactly what are the fixed interest rate alternatives of the home Security Financing TB ?

A choice of a predetermined interest rate can be obtained for one, 2, step 3, 5, 7 and you will ten years and/or entire financing installment several months.

At least a few months until the stop of your fixed attention speed period we will contact you on paper and you can allow you to be aware of the the new rate of interest and the fresh new repaired interest period. You could choose, whether you:

- accept new rate of interest together with fixed-rates months,

- undertake the deal to increase or shorten the repaired-price several months as well as the related interest.

How come the fresh session inside Tatra banka just do it whenever drawing the brand new loan? What are the results at basic fulfilling?

Consultation is the 1st step to find the financing. Agenda a night out together for the conference thru Dialog Live *1100. All of our financial lenders is borrowing from the bank benefits. You will see concerning the done give out-of financing factors during the the initial conference after which it could be for you to decide to combine the credit for the new house, auto loan, bungalow or possessions renovation.

Connect with us