The key holder of your own the fresh individual examining and you will/otherwise the newest private family savings may be needed doing a legitimate Internal revenue service Setting W-9 otherwise replacement Irs Setting W-9 to add particular distinguishing suggestions. You are at the mercy of backup withholding at the rate given from the You.S. Interior Cash Password if you can’t offer you to advice otherwise meet specific other conditions.

Constantly make sure most recent also provides personally best online casino savannah king for the bank, since the advertisements change seem to. If you’ve seen a great $450 bonus mentioned in other places, it could be dated information otherwise refer to a specific render not available to customers. The best picks are around for consumers along the You.S. regardless of where you’re also discover, subject to the new regards to for every savings account. Area Financial now offers an advantage out of $20 a month to own pages who’ve at least $750 inside the month-to-month head dumps, meaning you get having a totally free $240 for financial on the institution. Qualifying head places is payroll, your retirement, or Public Shelter payments and, in this first year, you won’t pay people repair charges.

Ultimately, if you aren’t willing to put increased-end bank card, consider these high starter notes otherwise you to definitely that have an excellent 0% introductory annual percentage rate provide. The capital You to definitely Promotion X Team credit also offers at the very least 2x kilometers for the all of the sales, and you will arrives full of advanced perks. The newest Alaska Trademark credit is vital-provides to possess repeated Alaska flyers. It offers benefits such free searched handbags, concern boarding, 20% straight back to your Alaska Airlines inflight orders, and you can Alaska’s yearly spouse food. The fresh Citi Strata Biggest cards is one of the finest all of the-up to starter travelling rewards notes.

Although not, your own rewards will likely be more worthwhile if you have a great advanced Chase Best Benefits cards, including the Pursue Sapphire Put aside or Chase Sapphire Common Credit. By the animated perks made to your Pursue Independence Endless to 1 of them notes, you might enhance their worth, because you you may consistently secure to the accelerated speed. Inside guide, we protection what’s needed for being qualified to your bonus, the best strategies for the bonus or any other factual statements about the newest Pursue Freedom Limitless card.

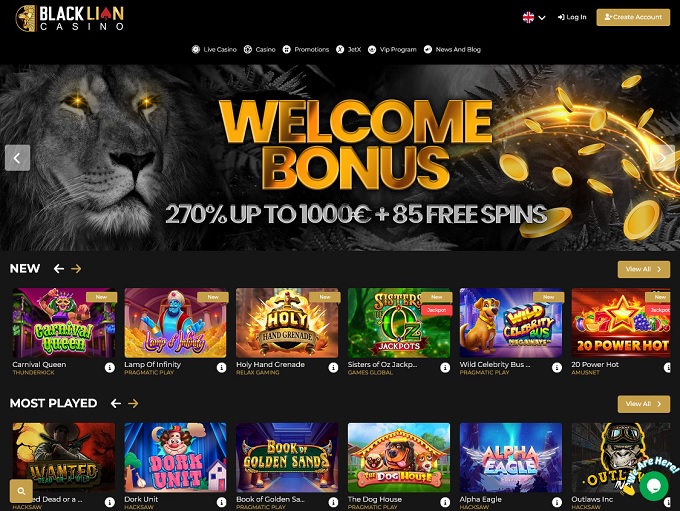

Times Gambling establishment Other Incentives – best online casino savannah king

The brand new Issues GUYThe $95 yearly percentage could easily be counterbalance by totally free night prize and you will solid money to your Marriott remains. Which credit is worth considering even although you usually do not remain at Marriott features seem to. As well, the newest cards have a great money costs round the several categories. Which card will probably be worth provided for your business even although you usually do not stay at Marriott characteristics frequently. The newest Aeroplan Mastercard is amongst the finest cobranded flight handmade cards on the market, which have redemption independency and you can beneficial trip professionals. Indeed there isn’t an appartment credit rating that can ensure their approval for another mastercard.

Southwest Quick Benefits Overall performance Business Credit card

Access to Admirals Nightclubs, numerous amazing benefits, and you can ways to spend on the elite reputation get this to a wise decision to own Western Airlines loyalists. You would imagine that you wear’t you need Uk Airways Administrator Bar Avios for those who have zero intentions to go the brand new U.K. Anytime soon, but Avios also are useful for scheduling brief-transport prizes in the You.S., with honours that have Oneworld lovers American Air companies and Alaska Airlines because the low as the 8,250 Avios one to-means. Because the Funding One to Strategy card doesn’t provide the special features of your Investment One to Promotion X card, it currently contains the exact same high acceptance offer and lots of strong advantages. The administrative centre You to definitely Venture X Perks Bank card is the premium Funding One traveling benefits cards on the market. Accessibility is generally impacted by the cellular provider’s exposure city.

If you’d like much more from your own family savings, imagine upgrading in order to TD Past Checking. So it account will pay interest which have a yearly fee produce (APY) from 0.01% and reimburses Automatic teller machine fees charged by the other banking institutions (for many who look after at least every day equilibrium away from $2,500). Pursue has to offer signal-right up incentives if you use a referral hook up and unlock a Chase Ink Team credit and you can over qualifying items. You might discover a good $750 in order to $step one,one hundred thousand bucks added bonus or 100,100 issues bonus. You can receive 100,100000 issues for $step 1,000 inside bucks otherwise $step one,250 within the traveling advantages as a result of Chase Biggest Benefits (issues are worth 25% much more when used for traveling through the Pursue webpage). Pursue provides 60,000 things to the fresh Pursue Sapphire Well-known cardholders.

Bank card welcome bonus also provides, sometimes known as the indication-up incentives, are constantly modifying, and also the worth of issues software can differ considerably. Using this type of month-to-month book, you can observe an educated acceptance added bonus offers offered and select a charge card one produces more valuable items, miles, otherwise cash-straight back for new cardholders. An excellent sign-up added bonus is one of the most significant benefits of beginning an excellent the newest charge card. Along with, sign-right up bonus also offers defense a general listing of costs, rewards types, and you will timelines.

This can be a reduced amount of an issue now given just how restrictive borrowing from the bank card issuers are very with applying for numerous playing cards. Which credit also offers one of many large uniform cash-straight back making cost of every card which is ideal for small-business owners who would like to generate profits back to your all the sales. It is really worth detailing that is actually a credit card, meaning cardholders must pay from other balances in full every month. To have an annual commission away from $95, the newest Enjoy also provides solid dollars-straight back making costs to the common and sometimes skipped categories, along with 4% right back on the dinner, amusement and you may preferred streaming characteristics. To earn the new $300 extra, anything you’ll want to do are discovered qualified head dumps totaling $500 or even more inside 3 months out of joining the brand new extra. A qualified lead deposit was a digital put from a paycheck, authorities pros, or a pension.

The brand new AAdvantage Professional Industry Elite group credit underwent a major renew inside the 2023, and therefore added the fresh benefits. Which cards is fantastic United kingdom Airways constant flyers, and you will traveling lovers are able to find the best value regarding the Traveling Along with her Admission. View best wishes methods place the Money One to Campaign X cards acceptance provide so you can a have fun with. Dependent on your travel wants and you can preferences, the administrative centre One to Promotion X credit could quite possibly become becoming your own go-so you can card on your own bag.

Digital Wallet out of PNC Financial

Chase Versatility Limitless also provides 3% to 5% back into bonus kinds out of drugstore using and you will dinner at the dining to search bought because of Pursue Travel. However, making the most of so it invited render and means far much more using than a typical invited added bonus. To make a full $300 benefit, you’ll need to make at the least $20,100000 within the requests along the first year — in the $step one,667 month-to-month. The brand new Independence Limitless’s greeting bonus also offers more well worth for brand new cardholders while in the the original year. Here’s things to know, and just how you could decide if the brand new Pursue Versatility Limitless borrowing cards suits you.

Totally free Spins Bonuses

Get the best charge card for your requirements from the looking at also provides inside the our credit card marketplaces otherwise score custom also provides thru CardMatch™. In case your credit score is too reduced in acquisition as approved to your Amex Blue Bucks Preferred card, then your number one focus will be for the boosting your credit rating first. At all, it creates no change how high away from a bonus provide you with come across for individuals who’lso are struggling to become approved on the credit. Using the CardMatch device, you could potentially found a deal as much as $300 to your Amex Bluish Bucks Common card.

Chase Bank ‘s the largest financial in the U.S., along with $step three.7 trillion as a whole assets. It’s my personal finest find to have a nationwide lender according to its aggressive financial issues. You’ll have access to more than cuatro,700 twigs, over 15,000 ATMs, and a leading-notch cellular app.

Connect with us