Small mortgage brokers are liberated to place her minimum financial amounts, very anticipate variability because you lookup your loan selection. Most loan providers try not to record this post on their other sites, thus you’ll likely need name or email. Lower than, we have gathered a summary of particular loan providers plus the minuscule financing matter every one of them also provides.

Brief real estate loan requirements

Small home loan loan providers usually want borrowers to fulfill the same minimal financial criteria as they manage to own larger financing wide variety.

- Good 620 credit rating or maybe more

- A step three% advance payment or maybe more

- An effective 45% debt-to-earnings (DTI) ratio or lower

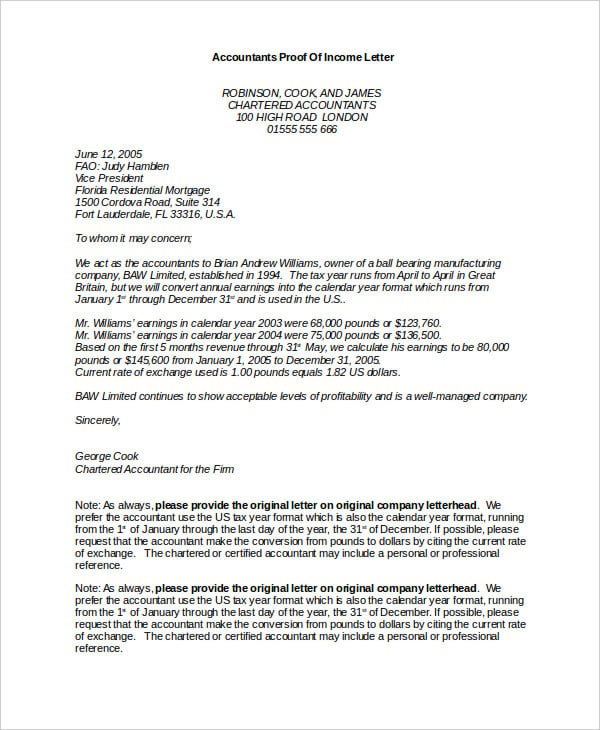

- Evidence of regular a position and income going back 2 years

- Personal home loan insurance coverage getting people and come up with a downpayment lower than 20%

Household standing

The residence’s standing is sometimes more critical in being qualified getting good short mortgage loan than it is to own larger finance. The reason is that of numerous home offering for under $100,000 you prefer tall home improvements. In the event that a property inspection reveals your domestic you’ve selected means a lot of rehab work to fulfill basic safety otherwise soundness standards, loan providers usually are reluctant to accept you to have a small-dollars loan.

Home updates are a major cause quick-dollars finance provides higher financing assertion rates when compared with significantly more old-fashioned mortgage brokers for more than $100,000. Yet not, one differences is actually very pronounced with traditional loans, that have highest rejection costs by the twenty-six commission affairs getting short loans, and you can the very least noticable that have USDA financing (eight payment affairs high).

Closing costs to possess small mortgages

This new closing costs for the a small mortgage ount than is common to have mortgage loans generally speaking. A common rule of thumb is for homebuyers you may anticipate so you can spend 2% so you’re able to six% of your loan amount in conclusion will set you back. However,, once the a number of the costs you only pay are repaired, individuals having a small amount borrowed will likely shell out proportionally a lot more in closure processes.

Benefits and drawbacks of brief mortgages

Reduce fee. Delivering a tiny home loan setting you can easily spend a lower minimum deposit. Such as for instance, if you purchase a $90,000 home and qualify for a traditional mortgage, 3% down might possibly be $dos,700. By comparison, 3% down on an excellent $300,000 residence is $nine,000.

All the way down monthly obligations. You can easily use quicker that have a small home loan. That means their monthly home loan repayments may also be all the way down.

Faster benefits. If you have some extra throw away earnings in order to expend on the money per month, you can repay your mortgage smaller than just your repayment label requires.

All the way down focus can cost you. Due to the fact you might be credit less overall, you can easily spend never as for the appeal than simply you’ll towards the a beneficial costly home.

You have fewer getting-deals home to choose from. Lower-listed homes are more difficult to track down, specially when you are fighting installment loans onlin Kentucky with real estate people who can pay for supply dollars upfront.

You really have a high mortgage price. Due to the fact loan providers wouldn’t generate as much cash on a tiny home loan mortgage, they might fees a high mortgage rate to compensate into minimal money.

Their probability of fighting with cash people are high. The low rate makes it easier for real property people otherwise domestic flippers in order to swoop during the which have bucks. In fact, a lot of brief-buck house aren’t purchased with home financing whatsoever, according to a report from the nonprofit think-tank, The fresh The united states. Additionally, data about U.S. Institution from Casing and you can Urban Innovation (HUD) suggests that simply 57% of individuals to find these types of domestic will use it a first house.

Your own closing costs could be more than questioned. As the lenders has at least fee it charge whatever the loan size, the settlement costs ount.

- Disincentives. Because they are usually paid-in profits, of numerous secret people regarding financial process – including real estate professionals and you will mortgage officials – have a tendency to do not have far added bonus to partner with homebuyers looking lower-cost residential property. The greater the home speed, the greater number of such benefits stand to make.

Connect with us