Household Lending Mentor

If you discovered the perfect domestic or you might be checking, looking at offered direction software helps you means a strategy for moving on.

: A predetermined-rate home loan now offers a regular interest rate for as long as you have the loan, in place of an increase that changes otherwise drifts on the field. A routine rate of interest usually means you will have an everyday home loan commission as well.

Joseph Shelly

: A supply loan is interested rate you to remains an identical getting a flat time, up coming alter to help you a changeable speed one changes from year to year. For example, a great 7/6 Sleeve have an introductory interest rate for the basic seven years right after which resets on a yearly basis then into loan label.

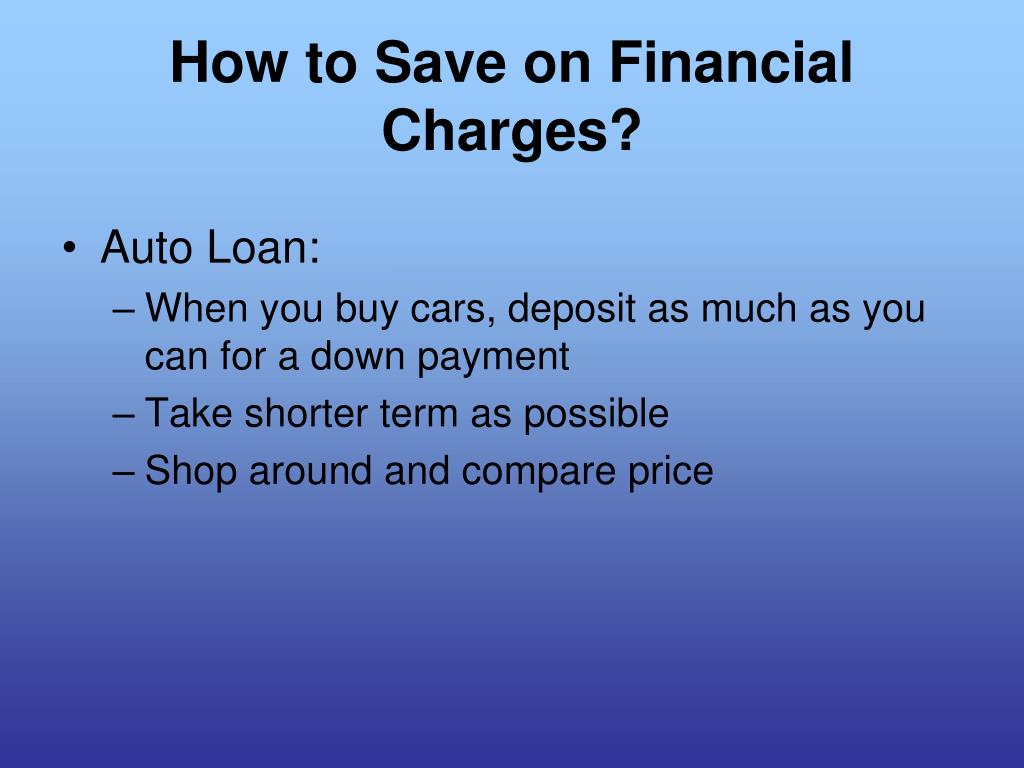

: The duration of the mortgage often perception the monthly payment. Including, the new reduced the mortgage name, the greater amount of you’re likely to spend monthly. Because you talk about selection, think about your advance payment, their month-to-month budget and you may bundle consequently.

: While repaired-speed funds give a constant mortgage payment, they often keeps a top interest. As you consider the choices, it’s also possible to inquire, “Is this my forever house, or maybe just a location in which I am going to real time for most many years?” Which can help you determine if a predetermined-rate mortgage is right for you.

: When you’re you will probably pay less interest rate into the introductory months, the percentage could improve substantially when this period comes to an end-possibly a lot of money 1 month. Rates limits reduce matter the rate of interest is also rise, but make sure to understand what the restrict fee might possibly be.

Your own Personal Coverage amount Spend stubs during the last a couple months W-dos versions for the past 24 months Financial statements for the past several weeks One to two numerous years of federal tax returns A signed price out-of revenue (if you’ve currently selected your domestic) Information about current personal debt, along with car and truck loans, student loans and credit cards

step one. Devices and hand calculators are supplied since a courtesy so you’re able to guess their mortgage requires. Performance shown is quotes just. Speak with good Chase Family Credit Coach to get more certain suggestions. Message and you will study rates get use out of your service provider.2. Towards Varying-Rate Financial (ARM) device, focus is fixed having an appartment loans Louviers time period, and you may changes periodically afterwards. At the end of the brand new repaired-rates period, the attention and you may costs could possibly get increase based on future directory cost. The latest Annual percentage rate may improve after the mortgage shuts.step three. Loans as much as 85% of good residence’s worth arrive to your a buy otherwise refinance without cash back, susceptible to property particular, an important minimal credit history and you may a minimum quantity of month-to-month supplies (we.e., you ought to booked enough cash in reserve making a good given level of month-to-month home loan repayments dominant, focus, fees, insurance policies and you can assessments following loan closes). Device restrictions incorporate. Jumbo finance offered up to $9.5 million. To possess financing amounts higher than $3MM (otherwise $2MM having financial support functions), users have to see post-closing investment criteria to help you be considered. Even more limits get apply. Delight get in touch with a great Chase Home Credit Coach to possess details.cuatro. The latest DreaMaker financial is only available for purchase with no-cash-away refinance from a primary residence step 1-4 product property to have 29-12 months fixed-rates words. Money restrictions and homebuyer education path is needed whenever the mortgage individuals are first-time homebuyers.5. FHA loans want an upwards-top financial advanced (UFMIP), that may be funded, or paid off at the closing, and you can an FHA yearly home loan premium (MIP) paid back monthly will also incorporate.6. Experts, Solution users, and you may members of this new National Guard otherwise Set-aside is generally qualified for a loan secured by You.S. Institution out of Experienced Factors (VA). A certification out of Qualifications (COE) from the Virtual assistant is required to document eligibility. Restrictions and you will limitations implement.seven. A preapproval is based on a glance at earnings and you can advantage recommendations you offer, your credit history and you can an automated underwriting system review. The fresh new issuance off an excellent preapproval page isnt a loan partnership otherwise a hope for mortgage acceptance. We may provide that loan union when you sign up and we also create a final underwriting comment, in addition to verification of every information given, property valuation and you can, in the event that relevant, investor recognition, that could bring about a switch to the regards to your preapproval. Preapprovals aren’t on most of the services can get expire immediately following 3 months. Contact a house Credit Mentor to own information.

Brand new NMLS ID is an alternative identity count that’s provided of the Nationwide Financial Licensing Program and you will Registry (NMLS) to every Mortgage Creator (MLO)

JPMorgan Chase cannot promote taxation guidance. Please consult with your taxation coach about the deductibility interesting and you can most other fees.

Connect with us