One of the largest misunderstandings with Va money is the fact residents envision Va loan entitlement can only be studied immediately following. That it misunderstanding is inspired by the requirement that house getting funded which have a Va financing need to be a first quarters. Even though this try a true requisite, people don’t understand that they aren’t required to take up a hundred percent of its qualification to their first house. Provided next house is as well as recognized as a great top house, you can financing more than one house or apartment with Virtual assistant financing. In reality, new Virtual assistant has no laws and regulations for how repeatedly you could use your entitlement. Using a beneficial Va financing to own next house is needless to say you are able to lower than numerous facts as long as you see the requirements.

Va Entitlement

Once one Virtual assistant loan try paid back, the new borrower’s entitlement was restored, in addition they are able to use an entire amount of entitlement with the the second loan. It is essential to remember that members of the fresh new military who qualify for a good Va financing are permitted 2 different types of entitlement: first and you will added bonus. The essential will provide you with $thirty-six,one hundred thousand of publicity getting residential property costing equal to or less than $144,100. The bonus will provide you with $144,000 away from coverage for property costing between one to count together with conforming restrict (usually $417,000). If you are using right up you to definitely on the earliest family, you’ll be able to use up next on your next household. But not, it is possible to fatigue all entitlement on one house in case it is higher-listed. In this case, you would not manage to pick another house with a great Virtual assistant mortgage until the first was paid-in complete.

To get an extra Home with a good Va Mortgage

You to requirements that accompany Va loan on 2nd house is that you have to confirm the following house provides you with a good web tangible work for. Remember that a large top priority with Virtual assistant financing is guaranteeing the new debtor is benefiting from the loan and people changes in order to it. A websites concrete work for you are going to are from swinging nearer to their work otherwise to shop for the next home to have a wife who life outside of the state. These scenarios tends to be short term. (Consider these scenarios if you were trying to sell the first household however, necessary the second house shorter than you could put your very first house on the market.) But remember that Va mortgage brokers can simply be studied to have land that are occupied by manager. To make certain that a property so you can qualify as the an initial residence, an owner must are now living in they at the least half a year and you will 24 hours each year.

Occupancy

And the no. 1 quarters laws, there is other occupancy laws to understand; people have to occupy your house within this two months of the loan closure. Which dos-times period is regarded as by the Va to get a good amount of time. Although not, there are numerous circumstances around which the client can be move for the following the two months. They might be the next:

- Army retirement within the next one year

- And then make requisite possessions repairs to satisfy MPRs

- If for example the circumstance will not match one of these Va affairs, you might complete a consult for your own uncommon situation accepted.

Intermittent occupancy normally recognized so long as this can be on account of a position. When your buyer intentions to use the family because the a vacation household, the new Va will not approve so it. The buyer should also improve Virtual assistant bank alert to the disperse-when you look at the go out and reason to possess relocating up coming.

Paid Home loan in full?

Such I mentioned significantly more than, your own full Virtual assistant entitlement is recovered when you pay back a great earlier in the day Virtual assistant mortgage. Such as for instance, imagine if you have repaid your current Virtual assistant financing but haven’t offered our home but really. Youre still capable pick the second house with complete Va qualification. not, you simply can’t get it done if your home is foreclosed toward or if you have to stop trying it within the a deed in lieu out-of property foreclosure. In order to get complete entitlement recovered, you are doing must sign up for they from Va.

Qualifying getting an additional Financial

So you can be eligible for a 2nd Va financial, your domestic will need to meet up with the exact same requirements are you aware that earliest loan. americash loans Woodmont Glance at but a few:

- Certificate off Qualifications (COE)

- Many loan providers need 620 credit history or even more (Lowest Virtual assistant Prices does not require it) however the Virtual assistant just listing suitable borrowing

- 41 per cent DTI otherwise straight down

- Adequate earnings

Get started on Buying another Household Today

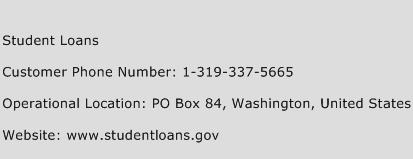

It does not matter your residence financing means, i within Reduced Virtual assistant Costs can help. If or not you desire one minute household, basic house, otherwise good refinance, call us at the 866-569-8272 to get going for the a loan application.

Connect with us