- Set a cost Goal to suit your brand new home. It might be $400,100 in a number of parts of NZ. It could be $800,100000. Know what you are was aiming for.

- Enjoys about a beneficial ten% put for the Price Mission. When you are aiming for $eight hundred,000, in that case your cash discounts, KiwiSaver and (potentially) Very first Family Grant are going to be at the very least $forty,one hundred thousand.

- Meet with a mortgage broker to assess if the money is actually sufficient to buy payday loan on sunday your Price Purpose. One Adviser should be able to let you know if for example the most recent income is enough to ensure you get your home loan. If not, it is the right time to envision paying off Credit debt or the Education loan.

An incredibly desire question and somewhat a fun you to (with many different numbers)! Let us see if we could crack it down into whatever you know:

- Handmade cards are usually doing 15%-20% interest rate

- College loans are typically 0% interest rate

Its ergo so much more financially in charge to settle your own Mastercard. But , settling your own Credit card may well not affect your earnings enough to get you your own financial.

Example

What if you have got an excellent $5,one hundred thousand Bank card and an excellent $5,100 Student loan. You’ve got $5,100 bucks where one can used to shell out that and/or almost every other regarding (however each other!). Imagine if you have made $70,100 per year and that using your $5,one hundred thousand dollars will not apply to their deposit.

The minimum fee to possess credit cards was 3% 30 days very a good $5,000 Charge card lowers your income of the $150. For folks who reduced the Charge card, you’d today be able to place one to $150 on your financial.

$500 monthly to your Student loan. For people who paid back your Student loan, you would today have the ability to put you to definitely $five-hundred onto your mortgage.

So the financially responsible experience to invest off your Borrowing Cards (because it’s to your fifteen%-20%) however, paying off the Education loan form you are even more attending get a home loan accepted.

Analogy dos

Things might possibly be a bit additional if you had $5,100 offers, a good $5,100 Mastercard but this time around a beneficial $10,one hundred thousand Student loan. As to the reasons? As paying $5,one hundred thousand of a good $ten,one hundred thousand Education loan will not connect with the functional earnings anyway. You nonetheless still need to pay $500 monthly into your Student loan and $150 a month into the Mastercard. Very in this situation, using the $5,100000 to spend down your Charge card will be the most readily useful choice because it perform provide $150 30 days to use to your home loan.

Summation

Paying their Student loan isnt an easy choice. The first thing you should choose is really what your purchase Speed Goal try. Following decide whether you really have (ideally) at the least a 10% deposit within the coupons. Following, if your earnings isnt sufficient to truly get your Pick Rates Mission, consider what financial obligation commonly really improve useable income to suit your mortgage.

Mortgage Lab’s objective is to be brand new digital urban area rectangular to have economic decision-companies to gain knowledge about their current and you will future mortgage. Follow you on Myspace and you can LinkedIn otherwise join the publication become notified your current articles.

Associated Articles

You’ll mothers use KiwiSaver as a way getting satisfying students in the form of pocket money? Keep reading to see how one of the website subscribers is successfully doing it and…

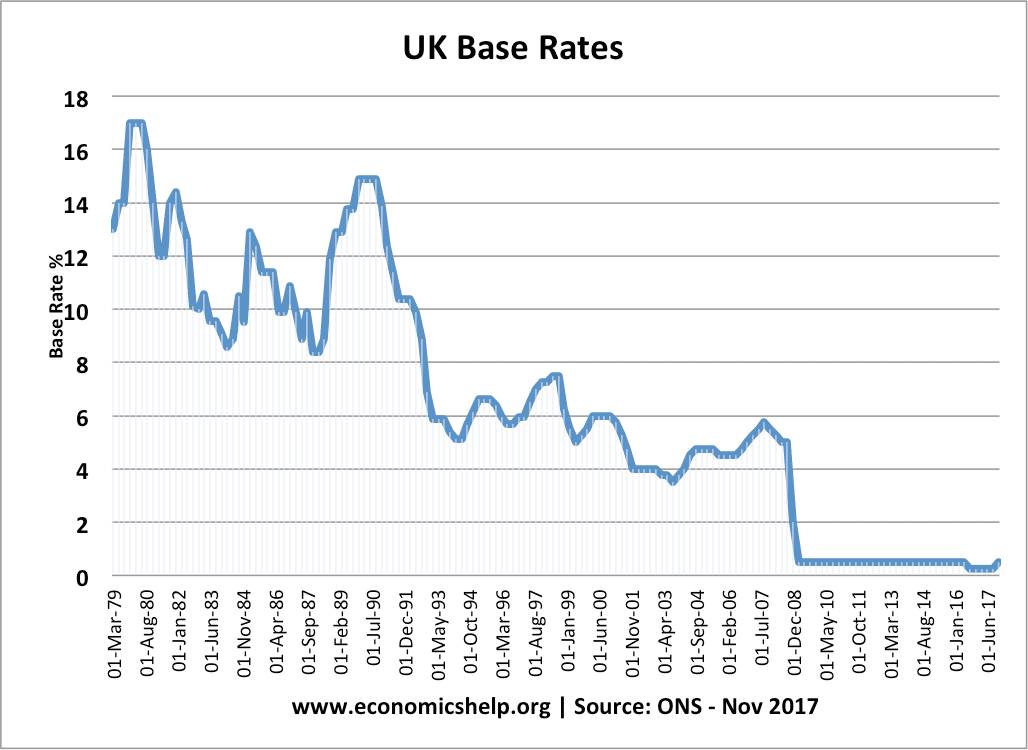

We are typing an unmatched day. The newest Set aside Lender has revealed a proper Cash Price increase off new historical low of 0.25% to dos%. Specific economists assume a recession…

Connect with us