It’s best to tell the truth regarding previous bankruptcies, whether or not it is gone from your credit history. It will save you go out, effort and money via your software.

Bankruptcies disappear from your credit file after six years, but most lenders will ask whether you’ve ever been bankrupt. It’s always best to be honest and upfront.

If you’ve been bankrupt in past times, the name’s wear brand new National Huntsman databases. This is certainly a databases that features men who’s come broke – even with they truly are discharged. It doesn’t matter if you own up to it, a loan provider can pick your on this subject database. Ensure that your broker and you will lender is aware of new bankruptcy proceeding very early. You don’t want to exposure being refused later on.

When looking for a mortgage after bankruptcy, it’s a good idea to work with a specialist mortgage broker. Someone loan places Sumiton who knows the market, has good relationships with the lenders who might accept you, and who knows how to make your application look good. That’s where our Mortgage Experts come in! Generate an inquiry to find out your options.

Ought i score a home loan once bankruptcy proceeding together with other borrowing issues?

Whenever are experienced to have an ex-bankruptcy financial, lenders may wish to pick a flush credit score because you had been declared broke. This will constantly getting a condition of one’s approval.

You should make sure any outstanding debts are paid in full before starting your mortgage application. Any new credit issues that have appeared since your bankruptcy (such as Personal debt Administration Preparations or CCJs) will make it a lot harder to get accepted for a mortgage.

Strategies for getting approved getting a mortgage immediately after case of bankruptcy

It’s not a good idea to rush into a mortgage application without speaking to a specialist. But there are a number of things you can do to improve your chances of getting mortgage after bankruptcy:

Go out it proper

Generally, the longer it’s been since you were discharged, the better you’ll look to lenders. Some lenders might approve you straight after discharge, but you’ll have to meet strict conditions and pay higher interest. Waiting a few years – and keeping your credit report clean in that time – will greatly improve your chances.

Work with your credit rating

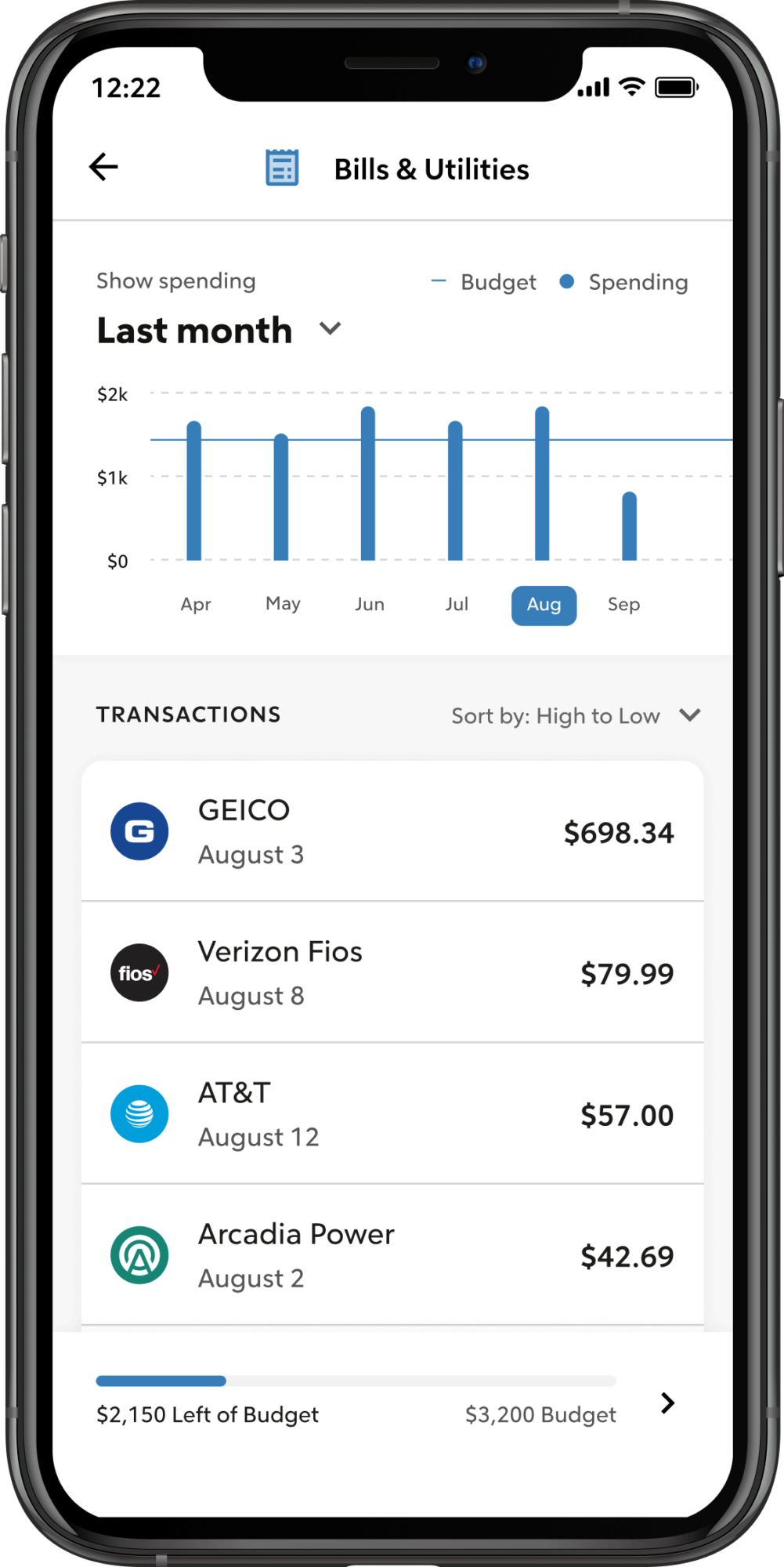

There are some simple ways to keep your credit file looking healthy. From correcting errors to registering to vote, it all counts towards building your score back up. Make sure you’re keeping on top of your bills and pay them on time. Read more tips in our Guide: How-to Replace your Credit score Before you apply Getting home financing

Get on most useful of the money

Possible browse safer so you’re able to lenders if you’re able to manage your earnings. Collecting documentation one to demonstrates you understand your earnings, outgoings and you will finances will highlight can alive inside your setting.

Lower your bills

The latest a lot fewer monetary obligations you’ve got, the greater. Spend as frequently out-of your debt as you are able to. This may tell you a loan provider you won’t be unable to make money.

Rescue a larger put

Saving a more impressive deposit form you happen to be inquiring to help you obtain less cash and to make a much bigger commitment. Most lenders ask individuals with past bankruptcies to get off a lot more money at the start to reduce the risk. Although that it would depend exactly how has just you were released.

Talk to an expert

When applying for a mortgage after bankruptcy, it’s best to speak to a specialist mortgage broker who can assess your unique situation and explain your options. Our Mortgage Experts know the market, which lenders are best for you, and how to give your application the best chance of being accepted. Make an enquiry to get going.

Connect with us