- Content hook up

- Telegram

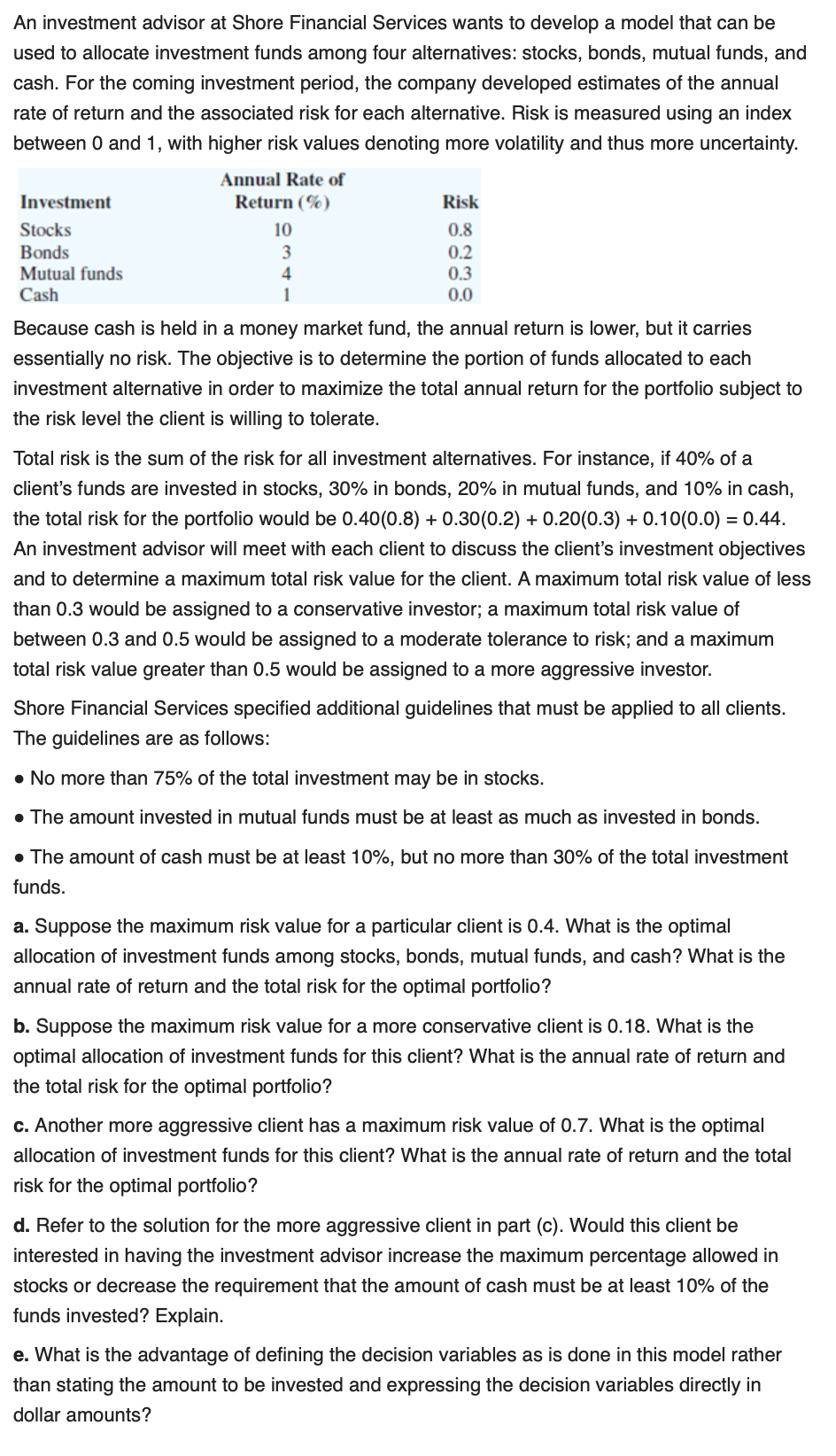

Earlier this few days, this new Put aside Financial out of Asia warned homebuyers to your creative family mortgage systems, popularly known as or strategies. The attention on these strategies got increased recently, while the developers and you will developers all the more think it is hard to access investment. The latest central lender enjoys certainly nipped the new expanding demand for new bud. This is because new design, within its most recent means, appears to give a brutal price in order to home buyers. Continue reading understand exactly how.

The first system

It system was pioneered from the HDFC, a frontrunner on the houses funds , Nahar class, an excellent Mumbai-established creator had tied up having HDFC to own program. Less than this original plan, the buyer paid back 20 percent out of full property value home as the upfront fee, and come paying the equated month-to-month instalments (EMI) shortly after getting fingers of the house. From inside the design months, HDFC offered design fund into creator below the Progress Disbursement Facility Scheme (that it also offers for other developers). Our loans Wedowee AL home consumer which didn’t have so you’re able to happen any exposure in addition to 20 percent in the eventuality of default because of the the brand new creator.

The newest tweaks

But not, subsequently, this new system and therefore sells an identical ‘ mark might have been modified with techniques introducing the home client in order to an enormous chance. In this new schemes, your house visitors pays the fresh 20 per cent of your own complete value of our house as the initial commission. Once more, the guy enjoys the brand new no-EMI period right up until he requires this new palms of the property or having a predetermined months for which this new designer features accessible to afford the pre-EMI focus with respect to your house client. Yet not, there clearly was a great tripartite between your builder, lender together with family client, the spot where the financing approved with the house consumer could be disbursed either upfront or as per degree away from build of the home. It’s two-fold implications. One to, the fresh new builder becomes minimal money in the rates of interest designed for home consumers, a very clear 3-cuatro per cent lower than what the builder do normally get out of banking companies. As well as 2, thehome client now undertakes the danger on the part of the newest designer. Whenever a builder try disbursed people count regarding the loan approved on the family visitors, the fresh new onus of cost falls on the visitors and not the latest developer.

RBI to your conserve

When you find yourself particularly techniques do offer a home buyer certain recovery towards the account of zero pre-EMI’ alternative, most remained unacquainted with the chance they certainly were confronted by, in case there are endeavor delays otherwise standard into the payment of the builder. Subsequent, people put-off payments of the builders otherwise developers on behalf of the new household customer, would also lower the credit score off homebuyers in future.

That have a standpoint to address like dangers so you can homebuyers, RBI sent a notification to finance companies emphasising that the borrowers might be generated familiar with its threats and obligations. The new RBI has urged banking institutions to not ever make initial disbursal in the event of partial otherwise the construction ideas. Finance companies have a tendency to today have to monitor the construction and you may link disbursals with the values regarding framework. Hence the risks so you’re able to customers could be mitigated to some degree.

Possessions sector people shared its look at just how RBI’s directive will effect builders and you may home buyers. Listed here is a cross-section off answers:

Risky

Sense membership from the finance is lowest and you will customers never understand the aftereffects of systems eg money, in the event the plans score delayed or if any kind of courtroom issue happen.

Of numerous customers do not understand they are by far the most unwrapped people from the tripartite contract between the bank, builder and you can buyer into the a keen financing contract.

Minimal come to, impact

Only around fifteen % of your supply in the business could have been using this type of promotion. Chances are high simply thirty five per cent regarding Amount A designers, below ten percent from Level B builders and you can very few Grade C developers provided so it scheme.

(Although) people needed for this proposition just like the a beneficial pre-updates to have booking, only less than half of your consumers in the end plumped for the brand new program.

Finance companies had contacted united states with this offer however, we failed to thought offering they. For the short term, a number of methods may see an autumn-aside however, overall conversion process was unrealistic is inspired.

Often moisten comfort

Developers which have higher pockets is also sustain, however the other individuals would have to sometimes have a look at selling the fresh new center assets so you can big developers otherwise slow down the rates expectations regarding homebuyers.

Connect with us