Monthly Spend: $step 1,

As Amortization Calculator may serve as a basic device to have very, if not completely, amortization computations, there are more hand calculators on this web site which can be more specifically geared to have preferred amortization calculations.

What’s Amortization?

There’s two general significance out-of amortization. The second reason is used in brand new framework out of organization accounting and you will ‘s the operate out of spreading the cost of a costly and you can long-lived items more than many symptoms. The two are said in detail regarding parts below.

Paying a loan Through the years

When a debtor takes out a mortgage, auto loan, otherwise personal loan, they usually build monthly premiums towards bank; speaking of several of the most common uses away from amortization. A part of the latest payment talks about the eye owed towards the financing, and the other countries in the fee goes toward reducing the prominent balance due. Attention is computed to your latest balance and thus tend to feel more and more quicker because dominant reduces. You’ll be able to get a hold of it doing his thing towards amortization dining table.

Playing cards, as well, are certainly not amortized. He could be a good example of revolving financial obligation, in which the a fantastic balance might be sent times-to-times, together with count paid off every month can be ranged. Please fool around with our Charge card Calculator to learn more or even to carry out computations connected with credit cards, or our Credit cards Payoff Calculator to plan a financially feasible answer to pay-off several handmade cards. Samples of most other money that are not amortized were desire-just finance and you may balloon financing. The former comes with an appeal-only chronilogical age of percentage, therefore the latter enjoys a massive dominating fee at loan readiness.

A keen amortization schedule (either titled an amortization table) are a dining table explaining for every single unexpected payment towards the a keen amortizing mortgage. Per computation carried out by this new calculator will also feature an enthusiastic yearly and you may monthly amortization schedule above. For every fees to have a keen amortized mortgage usually incorporate each other a destination commission and you can payment to your dominating harmony, which may vary for each and every shell out period. An amortization agenda helps indicate the particular amount that is paid down on each, plus the attract and you will dominating paid back so far, and the leftover dominating equilibrium after every shell out several months.

Earliest amortization times dont take into account extra repayments, however, it doesn’t mean you to consumers can not shell out more with the its finance. Plus, amortization dates fundamentally dont thought charges. Basically, amortization times only benefit repaired-rates financing and not changeable-rate mortgage loans, varying price fund, otherwise credit lines.

Spreading Can cost you

Certain companies possibly purchase expensive items that are used for enough time durations that are categorized while the investments. Items that are generally amortized for the purpose of dispersed will cost you were machinery, structures, and you may gadgets. Out of a bookkeeping direction, a-sudden purchase of a costly warehouse through the a good quarterly months can also be skew this new financials, so the worth is actually amortized over the life time of the warehouse alternatively. Though it is also officially qualify amortizing, normally, this is named this new depreciation expense out-of a keen asset amortized over their requested lifestyle. To learn more regarding or perhaps to do data related to decline, please visit the Decline Calculator.

Amortization as a means out of spread providers costs inside the accounting essentially relates to intangible possessions like a great patent or copyright. Around Section 197 out-of U.S. legislation, the value of this type of property shall be subtracted day-to-week otherwise year-to-seasons. Identical to that have all other amortization, fee schedules might be determined of the a computed amortization agenda. Allow me to share intangible assets that will be commonly amortized:

- Goodwill, the history of a business thought to be a quantifiable resource

- Going-concern well worth, the property value a corporate just like the an ongoing organization

- The latest team set up (newest employees, plus the experience, education, and knowledge)

- Providers guides and you can suggestions, operating systems, or any other guidance feet, plus lists or any other advice about the latest otherwise potential prospects

- Patents, copyrights, algorithms, procedure, models, activities, know-hows, forms, or comparable points

- Customer-situated intangibles, plus customer bases and you can matchmaking which have users

- Supplier-situated intangibles, like the property value upcoming requests due to current relationship that have manufacturers

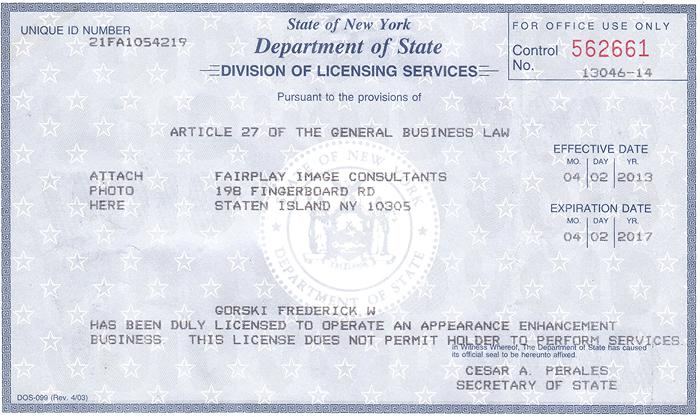

- Permits, it allows, or other rights supplied from the political http://guaranteedinstallmentloans.com/payday-loans-nj products otherwise businesses (plus issuances and you can renewals)

- Covenants not to ever participate or low-vie plans entered according to acquisitions out-of hobbies inside the deals otherwise companies

Specific intangible possessions, with goodwill being the most typical example, which have long of good use life otherwise is “self-created” ortized having tax objectives.

According to Internal revenue service below Part 197, some possessions are not noticed intangibles, in addition to demand for companies, contracts, homes, extremely pc software, intangible assets perhaps not received regarding the the fresh new acquiring away from a great organization or change, demand for an existing lease otherwise sublease away from a concrete possessions or established debt, liberties in order to provider home-based mortgages (unless of course it was acquired concerning the acquisition off a good exchange or company), or certain purchase will cost you obtain of the parties where any area out of a gain otherwise loss is not accepted.

Connect with us