In this post:

- How to get a federal Student loan

- Ways to get an exclusive Education loan

- Alternative methods to fund College or university

- Make Borrowing to have Coming Credit Needs

When it comes to capital your college education, credit money is among the many minimum tempting options. But also for of many students, it’s unavoidable. According to the National Cardio to possess Degree Statistics, 46% of one’s Category of 2018 likely to public universities was awarded student financing, having a higher level regarding borrowing from the bank from the personal nonprofit (59%) and private to own-finances (65%) associations.

Into the bulk from college students who need in order to obtain, providing a student-based loan through the federal government is almost always the leader. However if you may be a graduate college student or a pops looking to help your son or daughter make it through college, you may want to be interested in individual figuratively speaking.

Ways to get a national Education loan

Federal figuratively speaking are provided since the financial aid using your college or university. Because they are financed from the U.S. Department regarding Degree, government funds come with particular masters you’ll not rating that have private student loans.

Complete with entry to student loan forgiveness applications and you will earnings-determined fees agreements, including reasonable deferment and you may forbearance choice.

The process of providing a national student loan is relatively simple. You’ll start with filling in brand new Totally free App to possess Federal Student Aid (FAFSA). Using this, you’ll be able to share monetary details about yourself along with your members of the family to help the school’s educational funding work environment regulate how much assist you be considered getting in the way of college loans, grants, has and you can functions-studies apps.

Very federal figuratively speaking don’t need a credit check, so you can even complete the newest FAFSA which have bad credit or no credit score. Simply Direct In addition to Money, which are open to scholar and you may elite college students and moms and dads, want a credit assessment. Even then, the federal government will only see most particular negative activities.

Student youngsters with financial you desire will get be eligible for backed student loans, and thus the government pays the fresh accruing notice while you are in school, into the half a dozen-times elegance months after you leave college and you may throughout deferment periods.

Various other borrowers will get usage of unsubsidized financing, where https://elitecashadvance.com/loans/no-origination-fee-personal-loan/ you’re accountable for every focus you to accrues on the account. Student college students may additionally get unsubsidized finance once they do not meet requirements to possess subsidized funds otherwise enjoys maxed from amount it is also use.

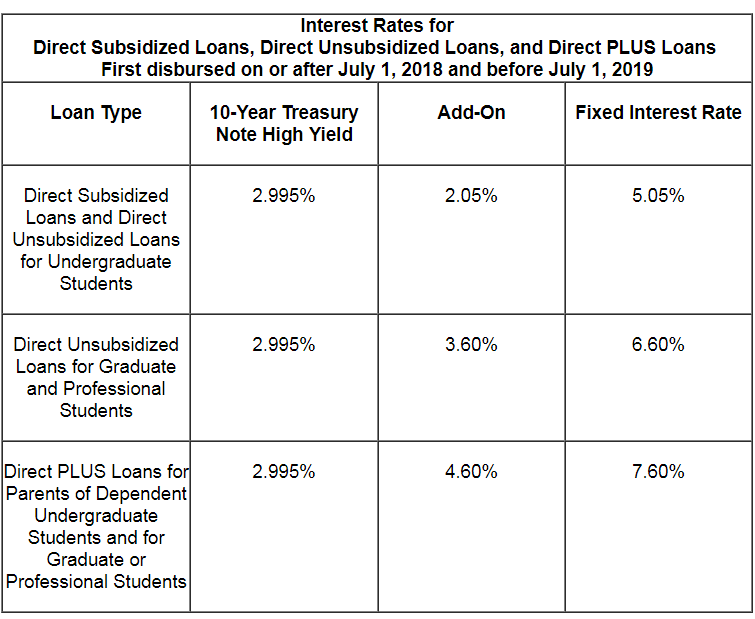

If you be eligible for federal figuratively speaking, the fresh words-like the interest, loan percentage and you can fees several months-try standardized, which means group just who qualifies to have a specific types of government financing gets the same terminology. For example, subsidized and unsubsidized government funds issued to undergraduates off , has actually a predetermined rate of interest of dos.75%.

Getting a personal Education loan

Private student education loans are faster appealing than just government finance since the they will not incorporate mortgage forgiveness software, normally carry highest interest rates and you may hardly have the advantageous asset of income-driven repayment arrangements.

In case you maxed your government loan constraints-you will find annual and you can aggregate limits-otherwise you might be a graduate college student otherwise moms and dad, they can be worth taking into consideration (especially if you have great borrowing).

Wanting a private education loan comes to using with individual private loan providers. Each one features its own requirements to possess choosing qualifications and also its very own gang of interest rates, installment words and other has actually.

Among the many drawbacks of personal student loans instead of federal financing is that personal fund generally want a credit score assessment. If you have sophisticated borrowing from the bank and a comparatively high earnings (otherwise an effective cosigner that have both), it more than likely may not be difficulty, and you will be also capable be eligible for a lesser rate of interest than what the us government now offers towards scholar and you may mother loans.

But if your credit history is bound or has many negative scratching and you also lack a beneficial creditworthy cosigner, you really have issue providing accepted.

Thankfully you to definitely private student loan organizations generally speaking make it you to receive preapproved before you fill out a proper software. This process demands just a delicate credit score assessment, and this won’t perception your credit rating, therefore allows you to find out if your qualify and examine rates proposes to enable you to get an informed offer.

If you are eligible, the brand new regards to your loan are different centered on their borrowing records, money or any other items.

Alternative methods to pay for College

When you find yourself student loans might be a handy cure for help you cope with school, reducing just how much you borrow makes a positive change to possess your financial coverage subsequently. Listed below are some alternative methods you could buy college or university one to do not require you to pay the cash back at the a later on time.

- Scholarships: Check your school’s web site to see whether it has got scholarships having instructional, sports or any other reasons, so if you’re qualified. Also, try to find scholarships on websites online instance Grants and you may Fastweb. You can easily filter countless opportunities to discover of them readily available for your.

- Grants: Part of the school funding process boasts gives for college students just who feel the financial you need, very completing your own FAFSA is a good idea, even if you cannot want to borrow cash. Together with, consult with your school and you will explore individual grant websites to analyze most other features. Specific grants may only be around so you’re able to children involved in particular college apps, or perhaps in particular areas of research, it will be beneficial to ask a teacher or educational coach do you believe will be knowledgeable.

- Part-date functions: Should your category plan allows it, try to find for the-campus otherwise off-campus operate so you can pay money for tuition, costs or other academic and you can living expenses. Even although you just performs a number of occasions weekly, your revenue can add up over time which help your stop thousands of dollars indebted during the period of your own university occupation. Your financial services bundle s for your school, which can make the whole process of finding a position easier.

It is in addition crucial to just remember that , selecting a reduced costly school and seeking with other a means to keep your costs off while you’re inside the university may go a considerable ways inside the assisting you to reduce your reliance on college loans.

Generate Borrowing from the bank having Upcoming Borrowing from the bank Need

If you believe you’ll need to play with personal college loans at one reason for the near future, or if you simply want to introduce a credit history for whenever you really need it shortly after graduation, the earlier you begin, the better.

While you are figuratively speaking can deal with you to definitely, they will not do much if you do not begin making costs, and therefore won’t happen for almost all until just after graduation. Student handmade cards shall be a great way to create borrowing from the bank as so long as you keep the harmony reasonable and you will pay their bill timely as well as in complete monthly, you could avoid appeal charges.

Although you work to make borrowing from the bank, display screen your credit score daily observe your progress, and you will address any potential items because they develop.

Connect with us