Yesterday, in a silly developing when you look at the state House, Wells chaired a hearing regarding the banking institutions Committee which payday loan firms received an unchallenged possible opportunity to give an explanation for property value payday advance loan.

It would be an excellent disservice if people lose the capability to become a payday loan, Wells said following speech.

The special procedures because of the payday loans market provided another illustration of the electricity in Missouri General set-up, whose customers gotten $383,050 in promotion contributions from payday loans organizations over the last 36 months. Rep. Mary Nonetheless, D-Columbia and recruit of an online payday loan reform bill, mentioned it absolutely was unjust the committee to learn about payday advance loan just from the field part. And she mentioned the panel got some blatant misrepresentations.

Usually legislative committees start thinking about bills in adversarial proceedings. A sponsor gift suggestions laws, and witnesses testify in service. Subsequently enemies are offered an opportunity to refute the proponents arguments. The trade helps committee customers decide on the worthy of of recommended laws.

But thats not really what took place with all the banking institutions Committee. After months of wait, quarters presenter Ron Richard, R-Joplin, on Monday delivered Stills bill for the committee for consideration. The rules would limit annual rates of interest for quick unsecured loans of $500 or significantly less at 36 percentage plus a one-time charge comparable to 5 percent for the loan up to at the most $25.

No hearing got planned on Stills expenses, but an unclear see for panel conference yesterday evening stated there would be a demonstration on financing. The speech, a pre-emptive hit on Stills expenses, ended up being all in favor of pay day loans.

On hand are the sectors lobbyists 24 hour payday loans Corvallis Oregon, John Bardgett of QC Financial service, Randy Scherr symbolizing United Payday Lenders and Mark Rhoads of Cash The united states Foreign. The committee was revealed a short video clip detailing the procedure of obtaining a quick payday loan from Advance The united states. The movie revealed it only takes a few minutes and little documents.

We assist people move forward to avoid late fees or large charge, said a voice regarding the videos. We create the cash advance techniques quick and simple.

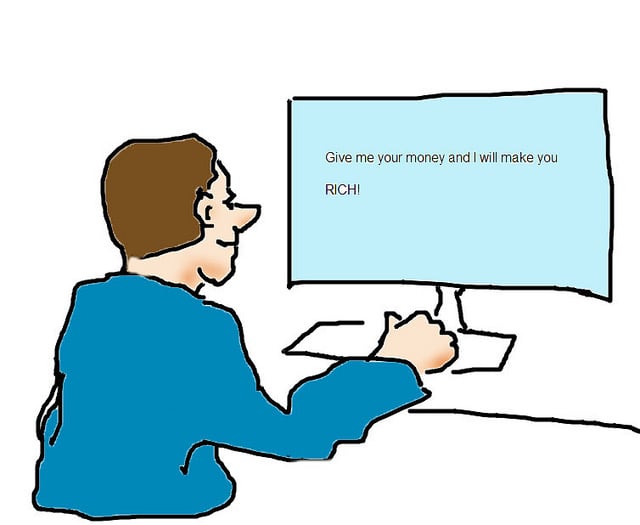

Gov. Jay Nixon provides known as pay day loan business a voracious predator that fees 430 % interest on a typical $290 loan. Matt Wiltanger, vice president and common advice of QC Holdings of Overland Park, Kan., informed the panel that the reason payday advances reveal large yearly interest is really because the attention energized is actually $20 on a $100 financing for two weeks.

Wiltanger said folk remove pay day loans due to unbudgeted costs. He mentioned without loans, a person could face bounced check always costs, bank card charge or utility reconnection charges.

Its within our welfare for people to pay all of us straight back, mentioned Wiltanger, whoever providers provided $219,450 to lawmakers governmental campaigns over the last 36 months. The guy included that in case interest is capped at 36 %, pay day loan businesses would go out of companies in Missouri, while they bring various other says.

After Nonetheless questioned Wells about the fairness associated with appointment, Wells responded that he desired the panel to own responses regarding the benefits of payday financing. He mentioned However could have the girl arguments heard if the costs came up about House flooring, that will be unlikely at this stage.

In a job interview, Wells said the guy failed to think the procedure is unfair. He stated the president of committee, Rep. Michael Cunningham, R-Rogersville, ended up being absent and had questioned him to put up the speech. Wells, that is vice chairman, mentioned it might be doing Cunningham to decide whether Stills costs gets a hearing.

Condition Division of Finance payday lending records program Wells do company as Kwik Kash in Cabool. Wells private finance disclosure report filed utilizing the Ethics percentage lists Kwik Kash as a single proprietorship that deals with small, small loans.

Records program Wells governmental panel, Wells and buddies, gotten $1,000 in venture contributions this past year from QC Holdings, $500 from Advance The united states and $250 from profit The united states.

Connect with us