Article Direction

For many of us, using up a home loan may be the most significant financial commitment away from their lives. Plenty of conclusion enter finding the best financing, plus the best way feeling really-equipped in order to navigate the process is to ask just the right issues.

Not every financial will offer an informed mortgage systems and you will terms to fit your demands, therefore you should be ready to comparison shop. Should it be very first household otherwise your own 3rd, such issues allows you to evaluate loan providers and pick a knowledgeable complement you.

step 1. What forms of mortgage loans might you promote?

This may started once the a shock for some customers that there are many sort of mortgages. Really customers understand the preferred kind of – conventional mortgage loans – but there are others one ideal suit your needs.

> Antique money: There are lots of sort of traditional finance, however, while they are not supported by one regulators institution, they are tougher so you can qualify for. Individuals typically need credit ratings regarding 620 or higher and you can good down payment with a minimum of 20% to end using personal home loan insurance rates (PMI).

> FHA financing: Covered from the Federal Construction Administration (FHA), individuals normally qualify for FHA financing that have as little as a great 3.5% down payment and credit scores as little as 580 – yet not easy loans to get in Elmore, you will have to spend one or two different varieties of FHA home loan insurance policies, irrespective of the advance payment number.

> Virtual assistant fund: Army people could possibly get qualify for a beneficial Va loan once they served long enough to make Va entitlement. Zero advance payment or financial insurance policy is required, as there are no lay lowest credit rating to help you be considered. But not, Va individuals generally spend an excellent Va capital commission anywhere between 0.5% and you can step three.6%, except if they are exempt because of a help-related handicap.

> USDA funds: The You.S. Agencies out of Agriculture (USDA) even offers mortgage brokers to aid low- to moderate-money family get residential property in outlying parts. Zero downpayment will become necessary and you can financing words is offer prior 30 years. Credit ratings of roughly 640 are essential, regardless if almost every other being qualified items can be believed rather than credit. Strict income constraints incorporate.

dos. What fees terms do you bring?

The word term refers to the timeframe you have got to pay-off good loan, when you find yourself terms relates to the latest cost and you will fees associated with the borrowed funds you will be using to possess. In the two cases, this new fees terms and conditions gets a primary influence on the purchase price of the financing cost, so it is vital to understand what the financial institution now offers upfront:

> Fixed-price financial: These financial provides a flat interest rate which is computed when taking your financing. The rate and you may dominant and attention fee would not change towards lifetime of the borrowed funds.

> Adjustable-rates financial (ARM): The rate to your an arm financing changes over the years during the put intervals – any where from a month to several decades – and then the price adjusts towards the a recurring base. Case finance usually initiate at the less 1st rate than just fixed-price financing, however when the reduced-rate months stops, the rate adjusts according to research by the terms of your own Arm (generally twice yearly or a-year).

> 15-seasons against. 30-year financial: A 30-year fees identity is normal for the majority of buyers because it brings the lowest monthly payment. Although not, a beneficial fifteen-12 months fees name are going to be recommended in the event you have enough money a top payment. A smaller label can save you thousands of dollars along side lifetime of the borrowed funds than the a thirty-season name.

step 3. What sort of bank will you be?

You should query which matter if you are not making an application for a mortgage together with your regional lender. Extremely loan providers fall under about three groups: financial lenders, home loans and retail banks.

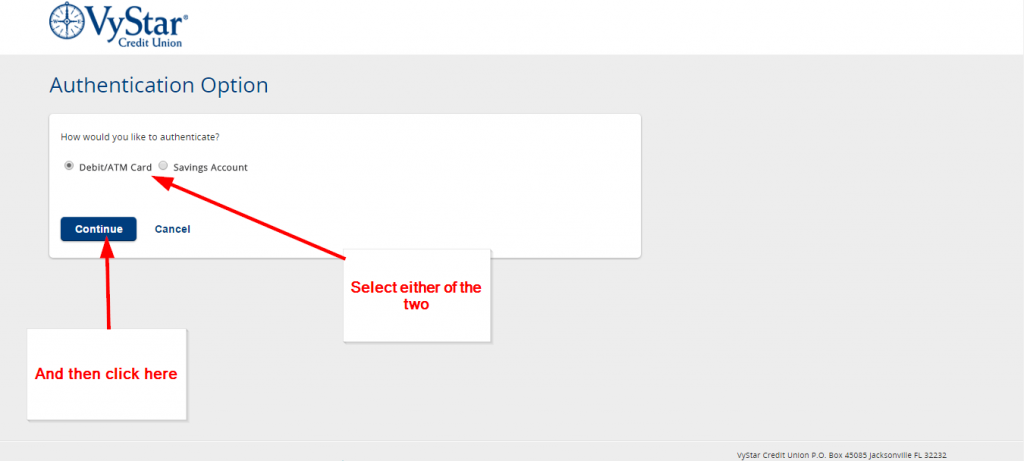

Connect with us