Ditech Mortgage brokers Back to Providers

In the future you might be viewing advertising off a new mortgage lender. Or rather, one which used to be a large player, and therefore next vanished and rose throughout the ashes.

I’m referring to Ditech Financial Corp., known affectionately as the ditech. Yep, they Eldridge loans might be right back, simply eventually to take part in the fresh new weakest origination season because 2000.

Towards the record, their name are designed by the consolidating Direct and you may Technical, and it’s lowercase since they are smaller compared to their uppercase Users. Which will maybe you have smiling right about today.

Now a tiny record the firm is established into 1995, located in Costa Mesa, California in which they went quite effortlessly up until it had been eventually shuttered this current year given that housing industry crumbled.

Subsequently, a lot changed, particularly brand new possession of the organization. These people were ordered because of the GMAC Home loan when you look at the 1998, right after which obtained by Cerberus Investment Management, in advance of later being bought of the Walter Funding Government Organization from inside the 2013.

Update: There can be somehow a whole lot more towards tale. For the , Walter Financial support Government Corppleted a monetary restructuring bundle and you can emerged out-of Chapter 11 bankruptcy underneath the term Ditech Holding Corporation.

This is basically the father or mother companys name, just after they altered their title once more, which have Ditech Monetary LLC and you may Reverse Financial Possibilities, Inc. performing beneath it.

Come back of ditech

In the , the firm launched it was into the borrowed funds game. It simply decided not to stay away, it doesn’t matter what tough they experimented with. It’s a common facts, extremely.

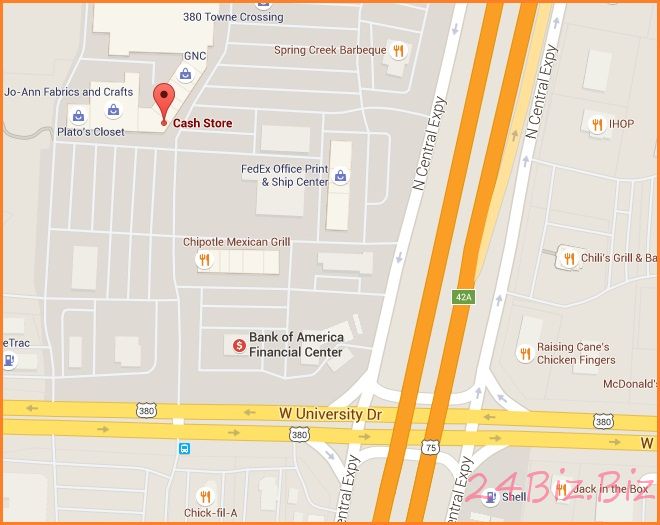

But not, today they truly are headquartered in the Fort Washington, Pennsylvania (where brother organization Green Tree Originations is additionally discovered), which have fantasies to take over the mortgage community once again.

- Direct-to-consumer credit thru their website and you may step one-800-amount

- Merchandising lending thru roughly 2 hundred financing experts across the country

- Correspondent financing having 600+ lovers

This means, you can rating that loan with them physically over the device otherwise on their website, personally that have a loan expert, or thru most other lenders you to sell the mortgage points through the correspondent route.

As much as home loan offerings, you are able to rating an adjustable-rate home loan, a fixed-rate mortgage, an FHA mortgage, an effective Virtual assistant loan, otherwise a beneficial jumbo mortgage. Really the only loan style of absent ‘s the less popular USDA financing.

Regarding the fixed mortgage institution, you can purchase often a 30-season repaired or a beneficial fifteen-seasons repaired. Little also appreciate or out of the ordinary there just like the we have been talking about fixed costs.

However, they are doing claim to render 8-12 months repaired mortgage loans in the event the conventional is not your look, along with other terms around, just as the YOURgage. This can be useful while you are refinancing if you don’t need to give the loan term and can manage big monthly premiums.

Its Possession come into three types, along with a 5/1 Sleeve, a beneficial seven/1, and you may 10/step one, all of which was hybrids, meaning they truly are repaired having an occasion prior to to get a year changeable.

Nevertheless they render FHA funds, HARP financing, and you will jumbo mortgage loans that have financing quantities of around $3 billion (doing $step 1.2 million to possess first-time home buyers).

And you can ditech provides a face-to-face financial business via part Contrary Financial Alternatives, Inc. if you find yourself 62 and you can more mature and not into making home financing percentage monthly.

The fresh new advertised financial prices on their site often want credit an incredible number of 720+ and you may lowest LTV ratios such as 70% max. On the other hand, max DTI may be 43%, and therefore matches to the Qualified Mortgage (QM) signal.

It seem to be an effective .125% otherwise .25% higher than exactly what I have seen has just with other huge mortgage brokers, for example Financial from The usa otherwise Wells Fargo.

Exactly why are ditech Mortgage Various other?

- He is an established brand many people have often heard out of

- Is also originate finance which have few overlays due to good backing

- And they have an excellent correspondent credit office

- As well as a general program

Except that its lowercase name, they’ve got a number of book qualities. For 1, they are a reputable brand with a lot of support about him or her, so they can originate funds having couple institution overlays.

It means it is possible to make the most of so much more aggressive and versatile home loan underwriting recommendations one to other banking institutions and you may mortgage loan providers is almost certainly not willing to give.

They also give you the Fannie mae MyCommunityMortgage, the brand new FHA’s $one hundred down payment loan system, offered lender-paid back home loan insurance, together with Freddie Only program, which enables these to accept LP (Financing Prospector) findings of Freddie Mac computer.

In the event you be an excellent correspondent lender, you should have the ability to rate, lock and you can send personal loans via the ditech webpages.

On the whole, it appears as though what’s going to lay her or him aside is their size/backing/familiar term. The majority of people have a tendency to remember him or her and that will be sufficient to let them have a benefit, or at least a base back into the entranceway.

I would ike to come across a little bit more technology from them given its in their name, but obtained made no reference to having the ability to fill in documents online and/otherwise tune the brand new status away from financing on line. That would be a nice contact, specifically utilizing the fintech professionals growing within this space.

They simply browse a little while generic and no genuine novel features when the things, they is like a good throwback so you’re able to a decade ago, in the place of a separate attention. Possibly they should provide the mortgage apps interesting names particularly Quicken’s Rocket Home loan.

Lastly, simply to get this upright, around three big lenders (and many smaller of those) transpired within the current homes crisis, also Nationwide, IndyMac, and you can GMAC.

Today, obtained morphed into Lender from America/PennyMac, OneWest Financial, and you can ditech, respectively. It will be fascinating observe what they become this time once the home loan field continues to recreate alone.

Update: Ditech also provides mortgages in just step three% down via the the latest Fannie mae 97 program. On top of that, it recently circulated a general lending station and are now accepting applications away from lenders.

Ditech Would be on the market

- The company established when you look at the late

- It absolutely was exploring strategic selection

In just a few quick many years once the business relaunched, ditech claims these days it is exploring strategic options towards assist regarding Houlihan Lokey as their monetary advisor.

By way of ascending home loan cost, many shops provides often signed otherwise sold-out for other competition. And exactly how things are heading, mortgage origination frequency is expected to miss next.

Therefore it is not sure in the event your company is just seeking to place on fabric early in advance of something receive any tough, or if there was another reason trailing the fresh new effort.

Anyway, this might spell the genuine avoid to have ditech, although brand name certainly enjoys stamina and value.

You’ll be able a beneficial suitor you can expect to keep up with the title and construct it off to satisfy the loves from the present financial disruptors, however, you to definitely remains to be viewed.

Connect with us